Global Freedom Solutions - Built Without Borders

We help entrepreneurs, investors, and freelancers build companies, open bank accounts, secure residencies, and optimize taxes — worldwide.

Trusted by more than

0 clients

who optimized their global setup and unlocked more freedom.

Legally stop paying unnecessary TAXES.

SIMPLIFY your structure and fully focus on your business.

Protect your ASSETS with secure, compliant international setups.

Time, location, and financial FREEDOM — the ultimate entrepreneur’s dream.

Dear Entrepreneurs, Investors & Freelancers…

Marius Alexander Walter - Founder GFS

We know the journey you’re on. You’ve worked hard to build your business — with late nights, bold decisions, and a vision for more than just survival. You didn’t choose this path for safety. You chose it for freedom.

But here’s the reality:

Too many ambitious entrepreneurs are still trapped by borders, outdated tax systems, local bureaucracy, and banks that make global growth harder than it should be.

You don’t have to play by those old rules.

The world has changed — and today, with the right structure, you can:

Legally reduce your taxes and stop overpaying governments that give you little in return.

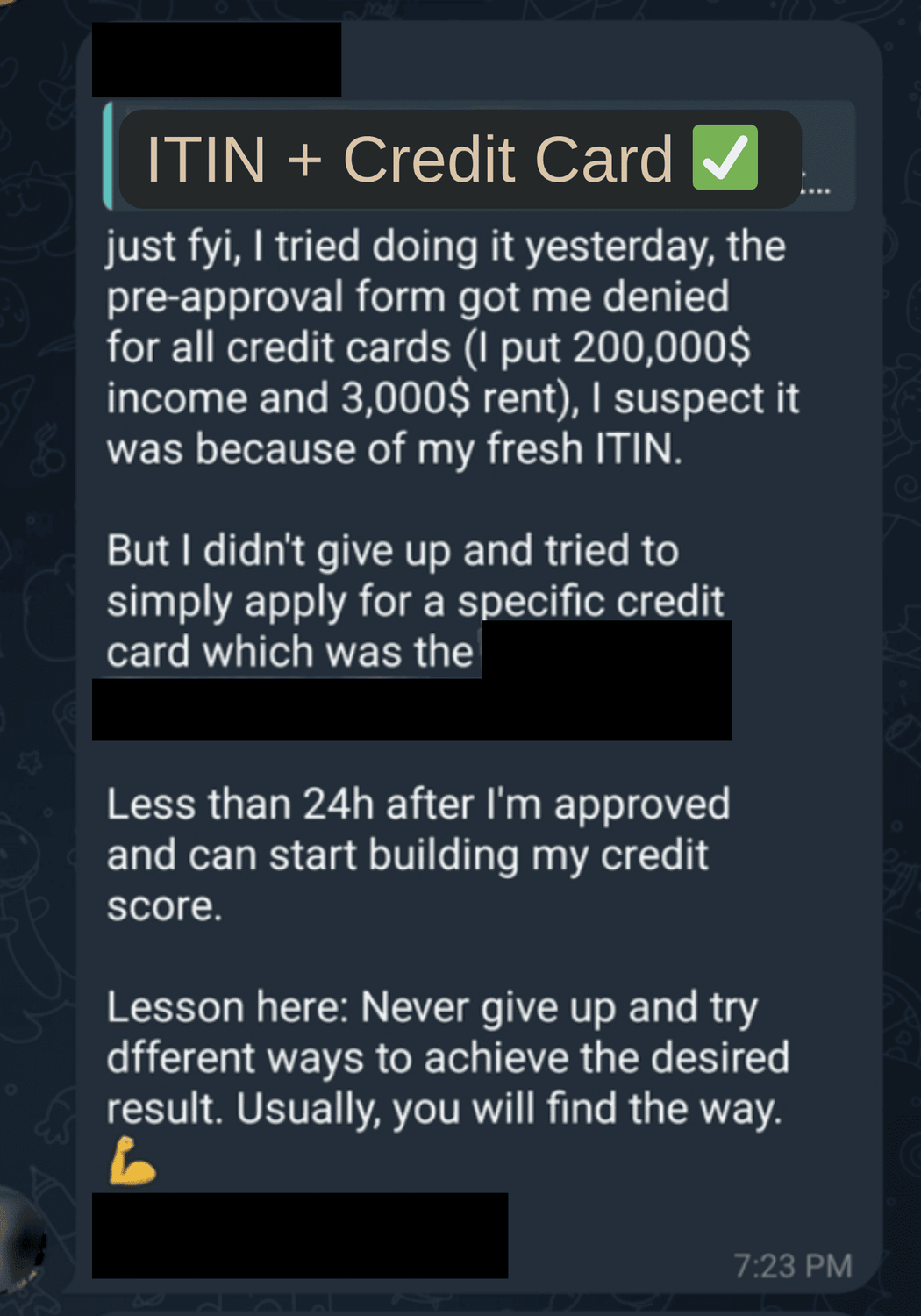

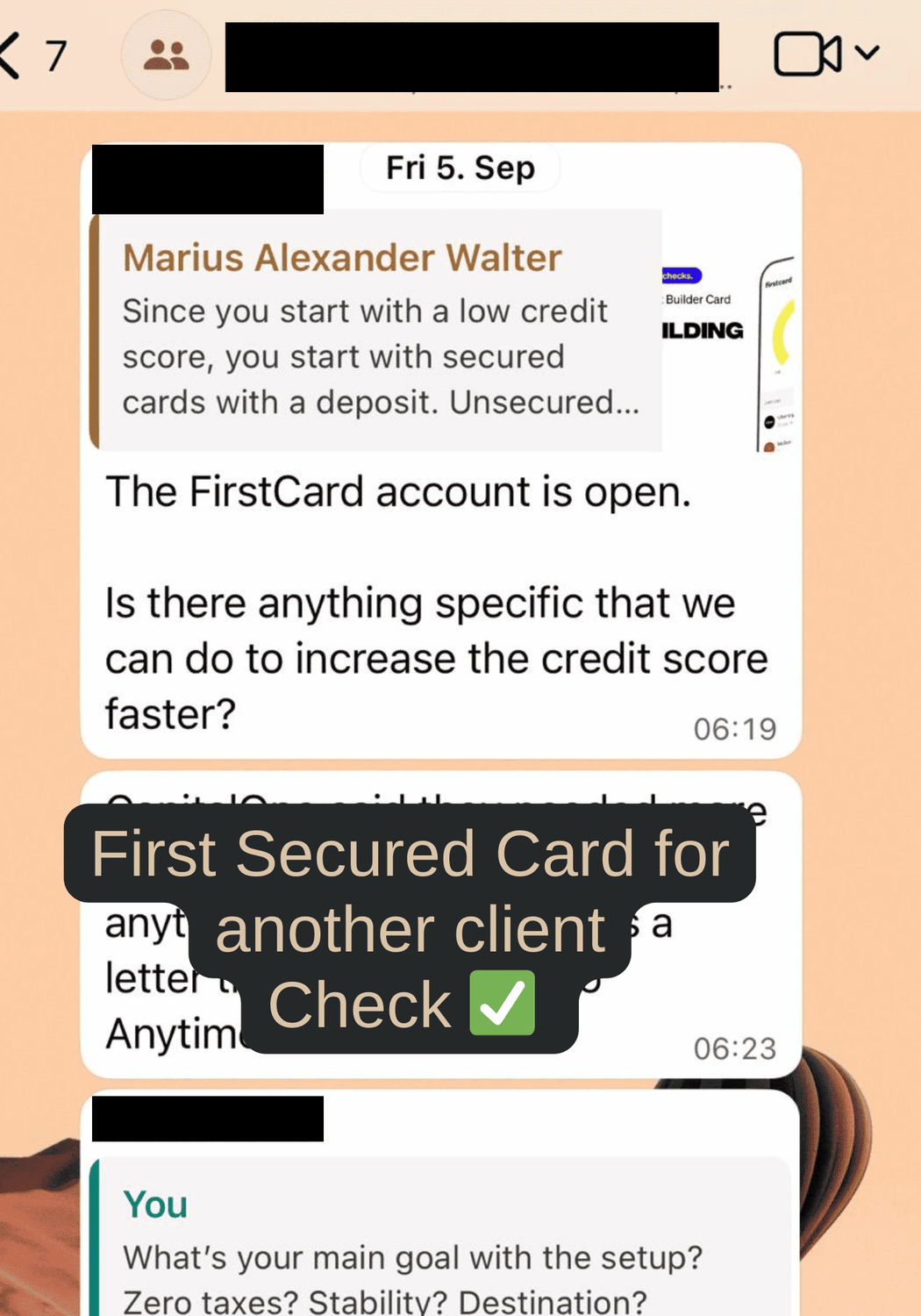

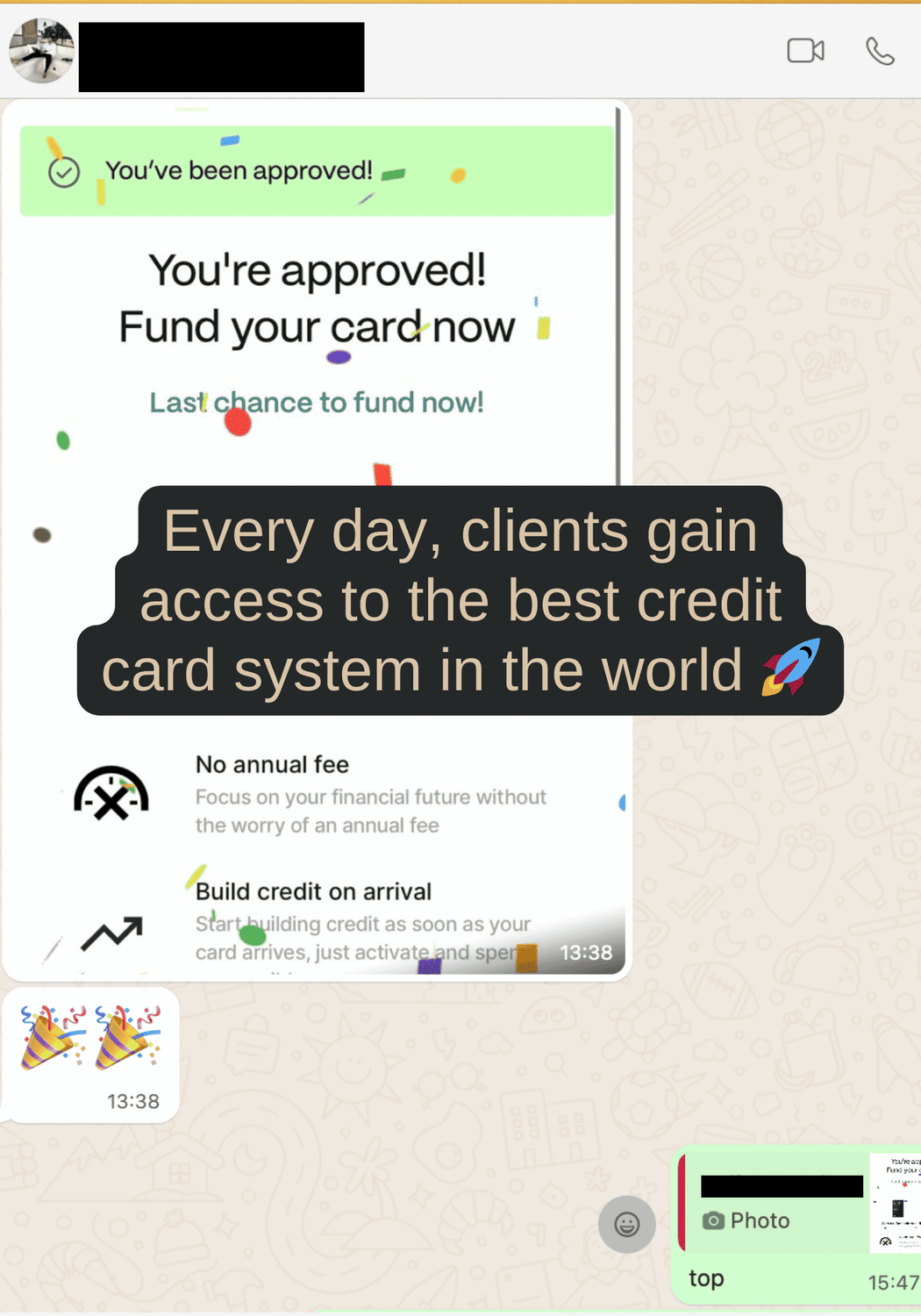

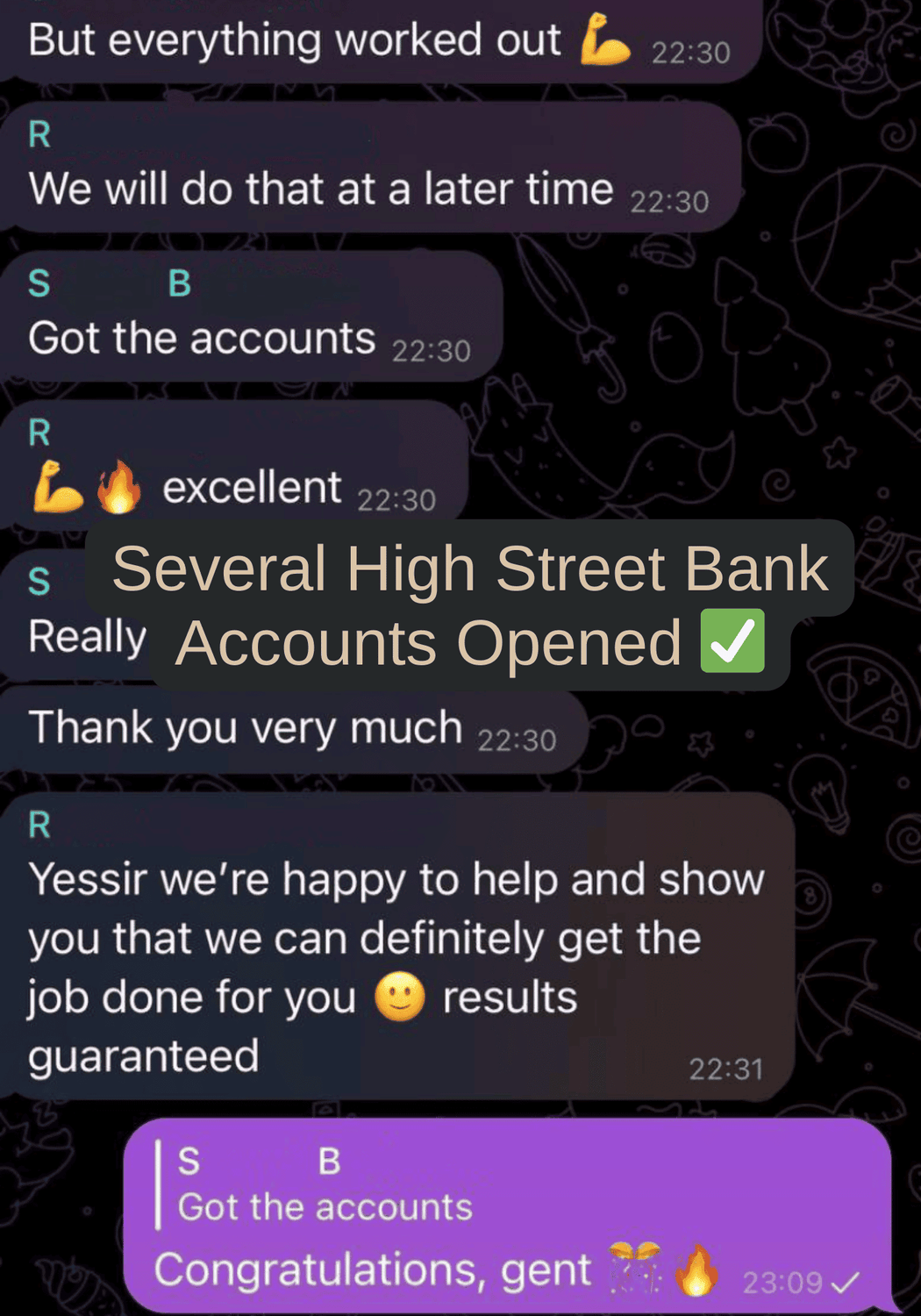

Access global banking and premium credit cards, designed for entrepreneurs like you.

Protect your assets and safeguard what you’ve worked so hard to build.

Cut through bureaucracy so you can finally focus on growth instead of paperwork.

Gain true freedom of choice — to live, work, and invest wherever it makes the most sense.

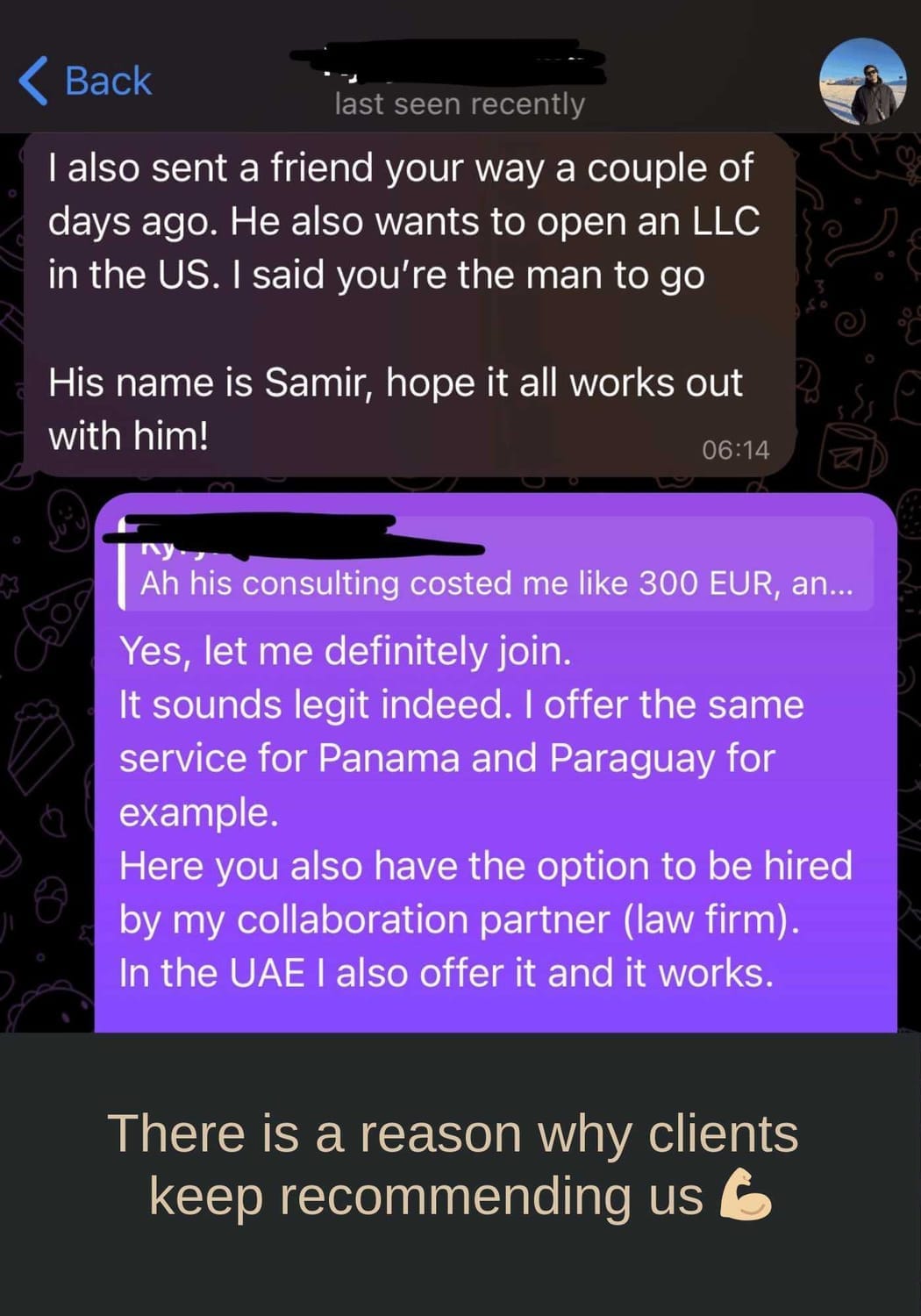

At GlobalFreedomSolutions, we’ve already helped more than 1,000 clients make this shift — not with hacks or loopholes, but with proven, legal structures that unlock opportunity and security worldwide.

Your business deserves to breathe.

Your lifestyle deserves freedom.

And you deserve to know that you’re playing the global game on your terms.

👉 Explore our most popular services and see how we can help you build without borders.

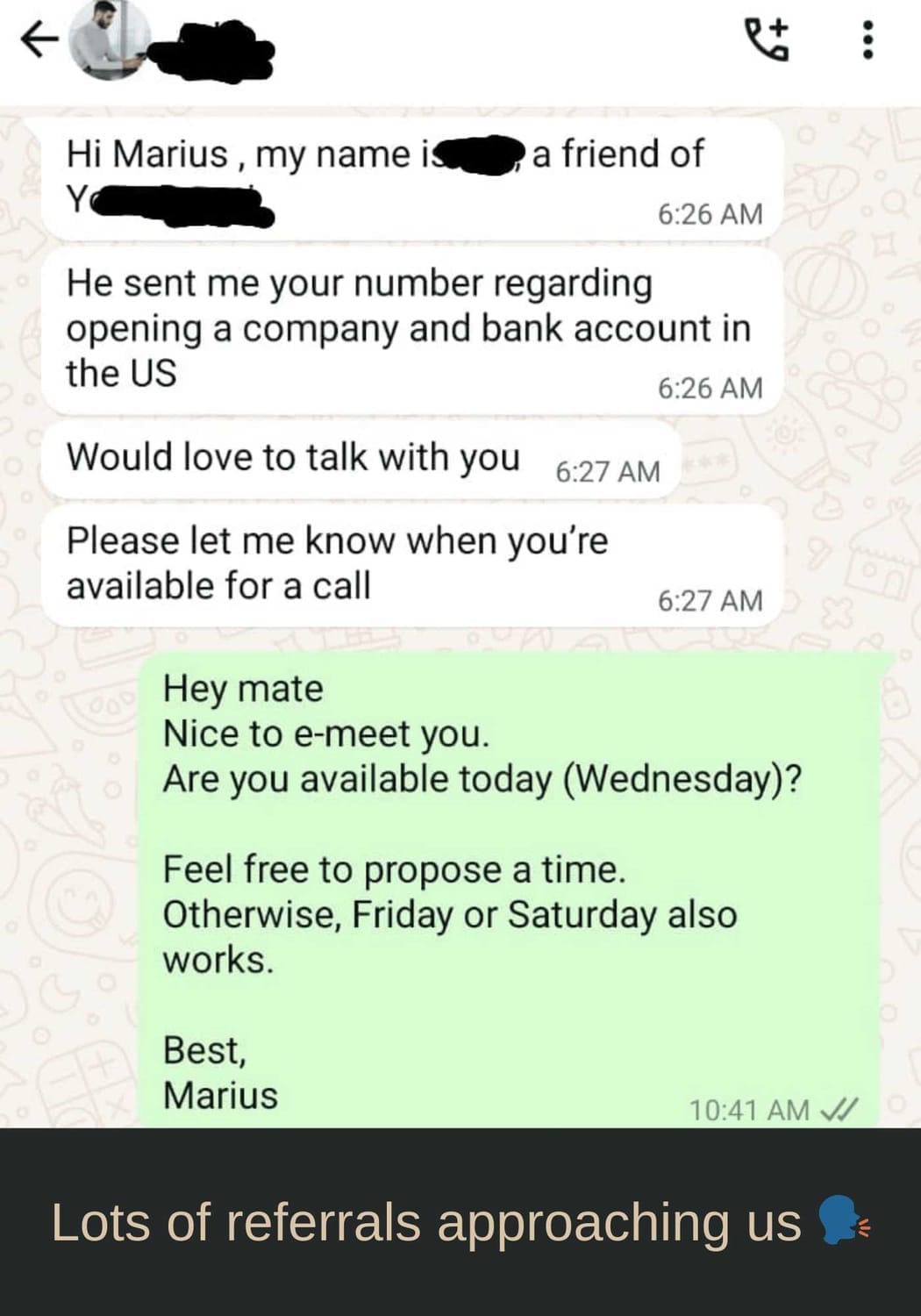

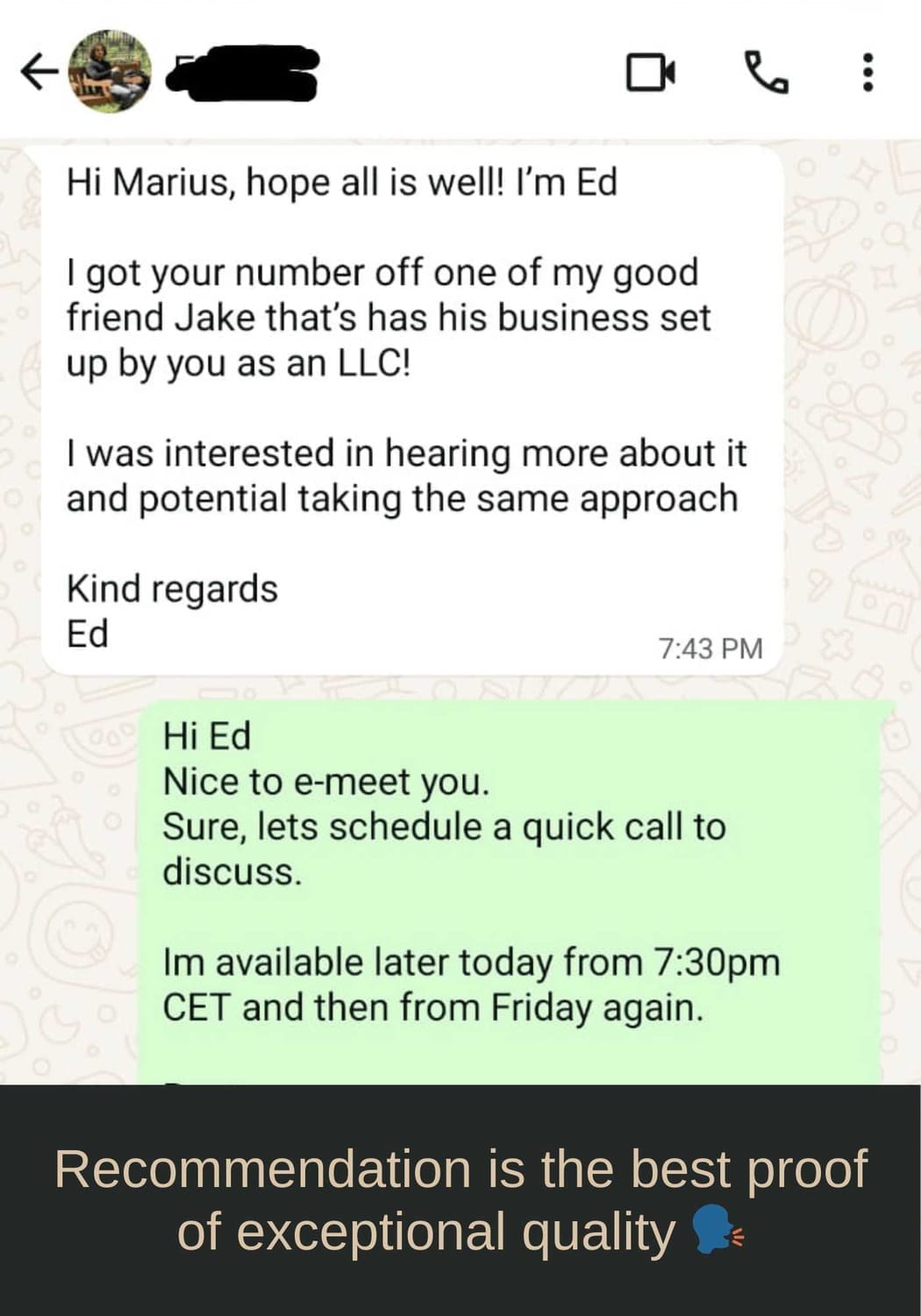

1,000+ clients trust our expertise.

1,000+ clients trust our expertise.

Marius Alexander Walter - Founder of GFS

Get to Know The Founder

Global Freedom Solutions (GFS) was founded by Marius Walter, a seasoned tax expert with extensive experience in advising entrepreneurs, investors, and businesses on international tax optimization and corporate structuring.

Before establishing GFS, Marius worked at KPMG AG in Germany, specializing in tax advisory, auditing, and capital markets consulting. His background in one of the world’s leading consulting firms provided him with deep expertise in complex tax strategies, banking, worldwide company structuring and compliance across multiple jurisdictions.

With GFS, you gain access to first-class expertise in global tax strategy, international company formations, banking solutions, and asset protection—ensuring you operate efficiently and securely in today’s fast-changing financial landscape.

Globalfreedomsolutions, the Original, known from:

Our most popular solutions.

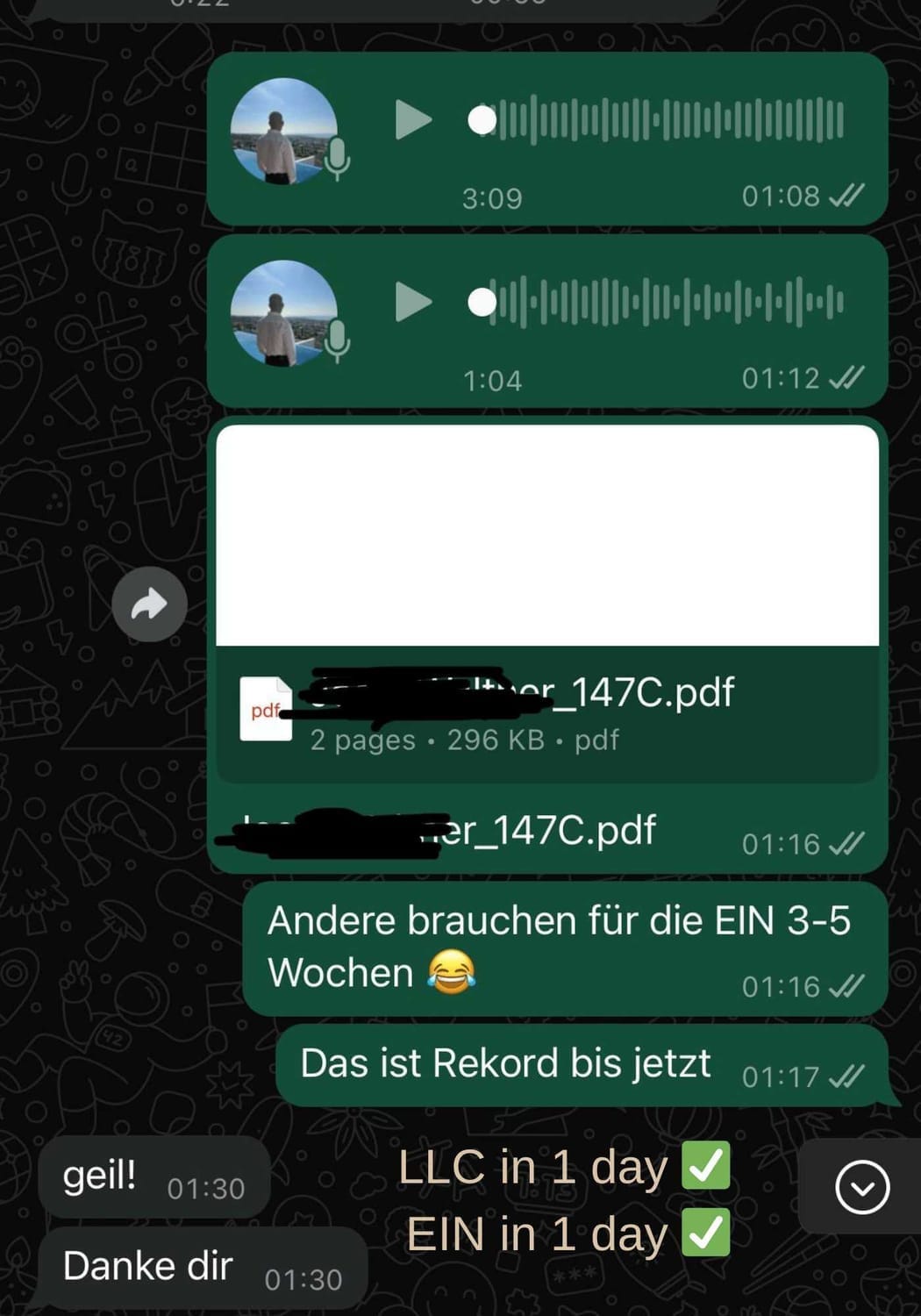

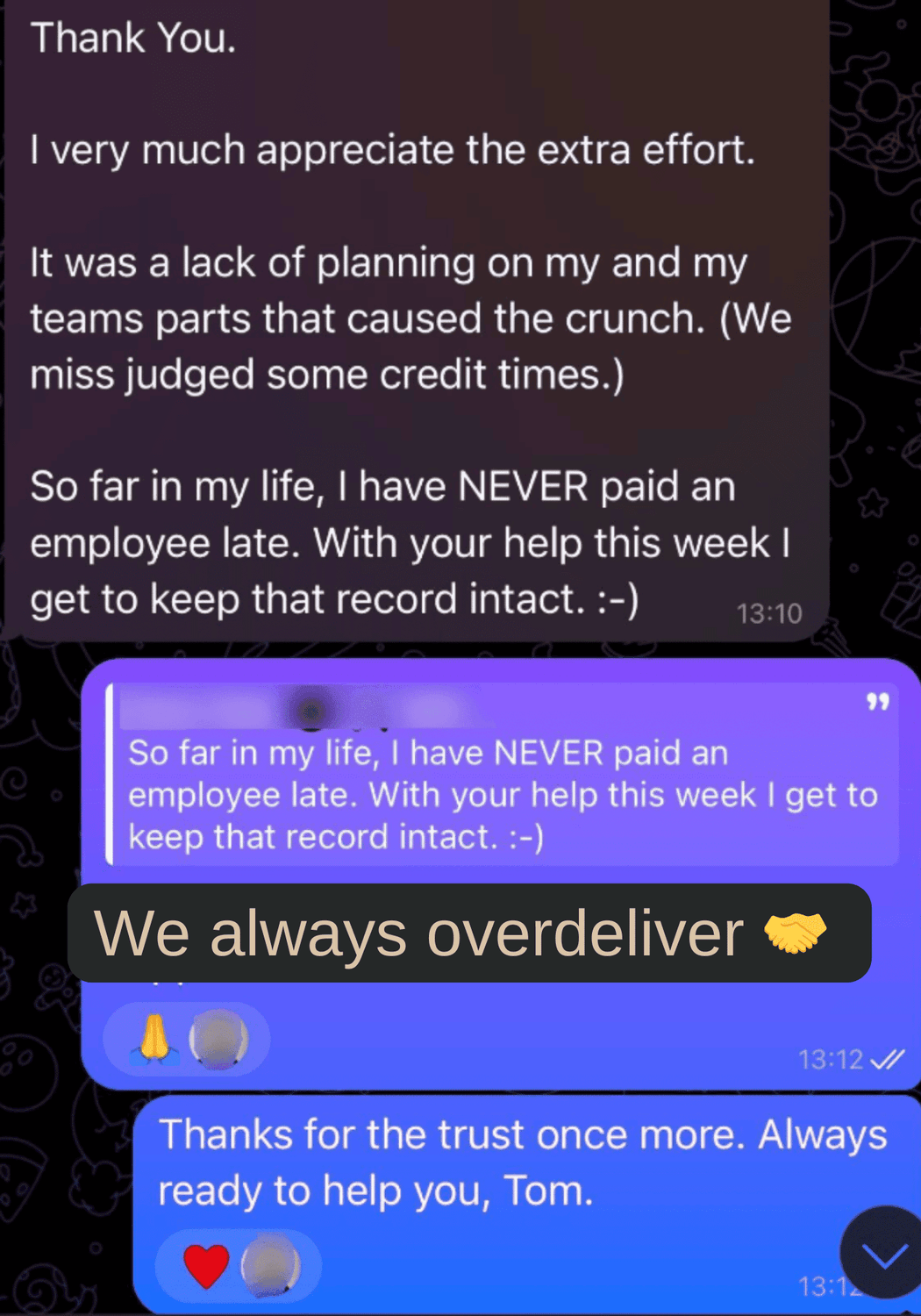

We Always Deliver.

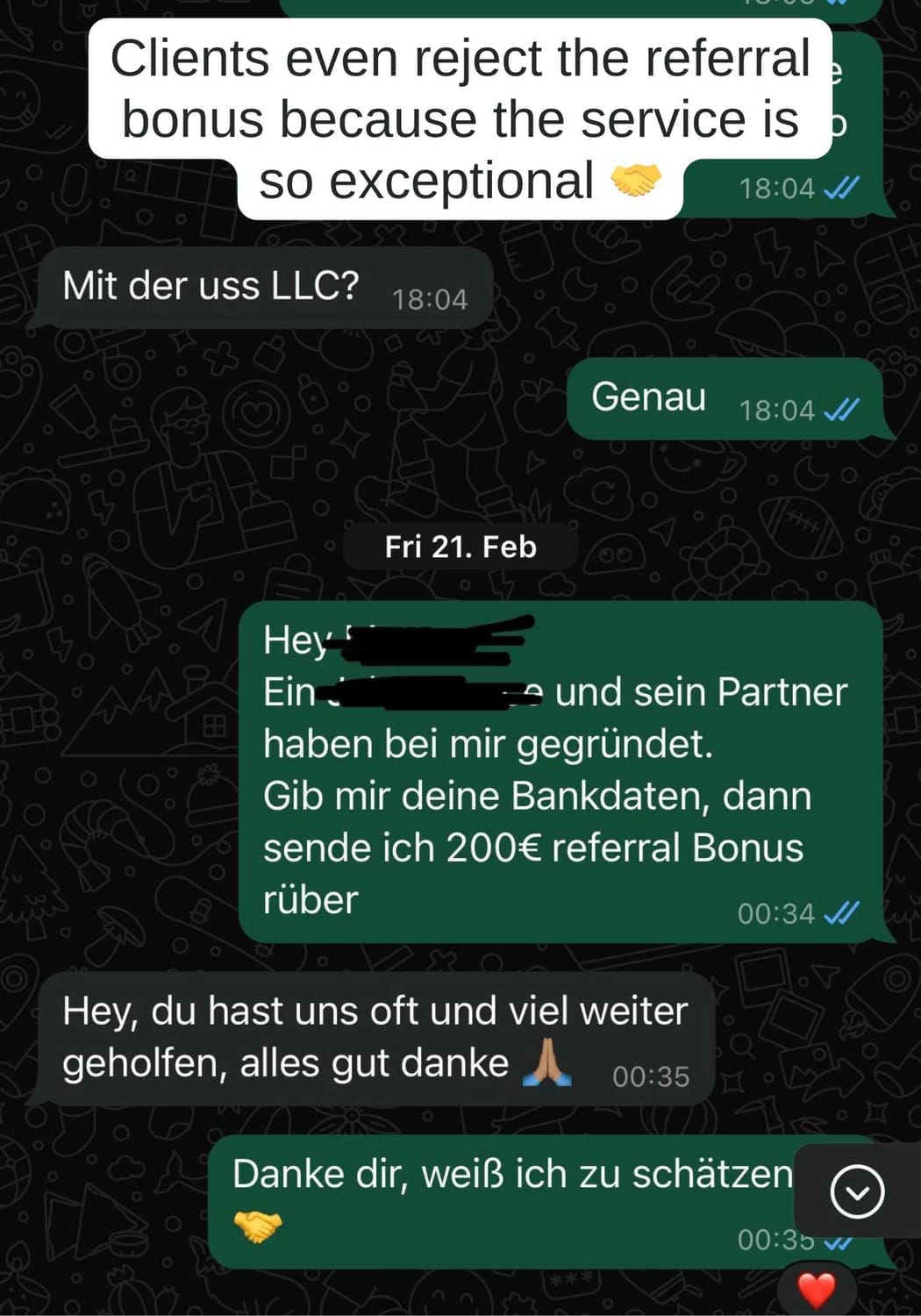

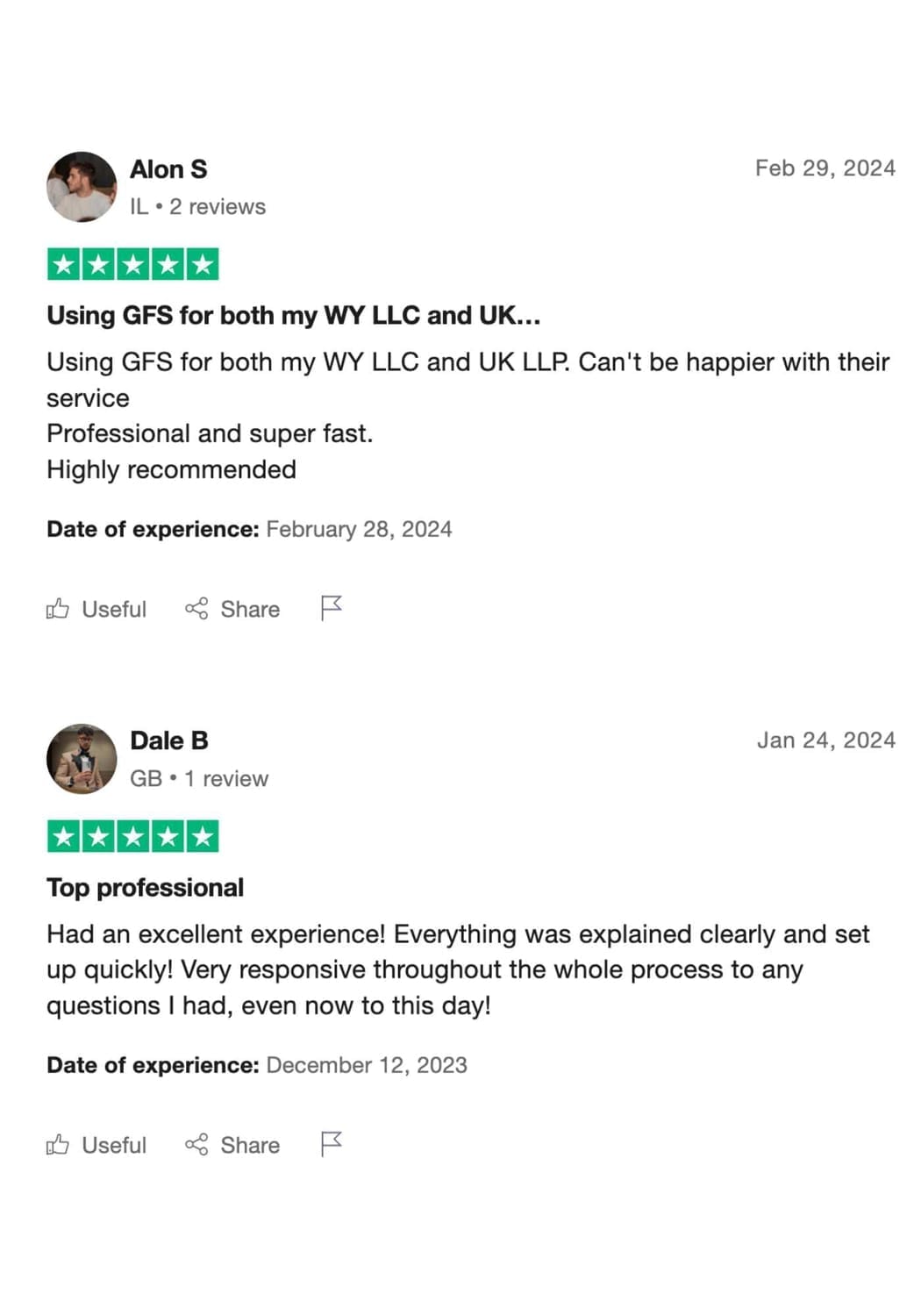

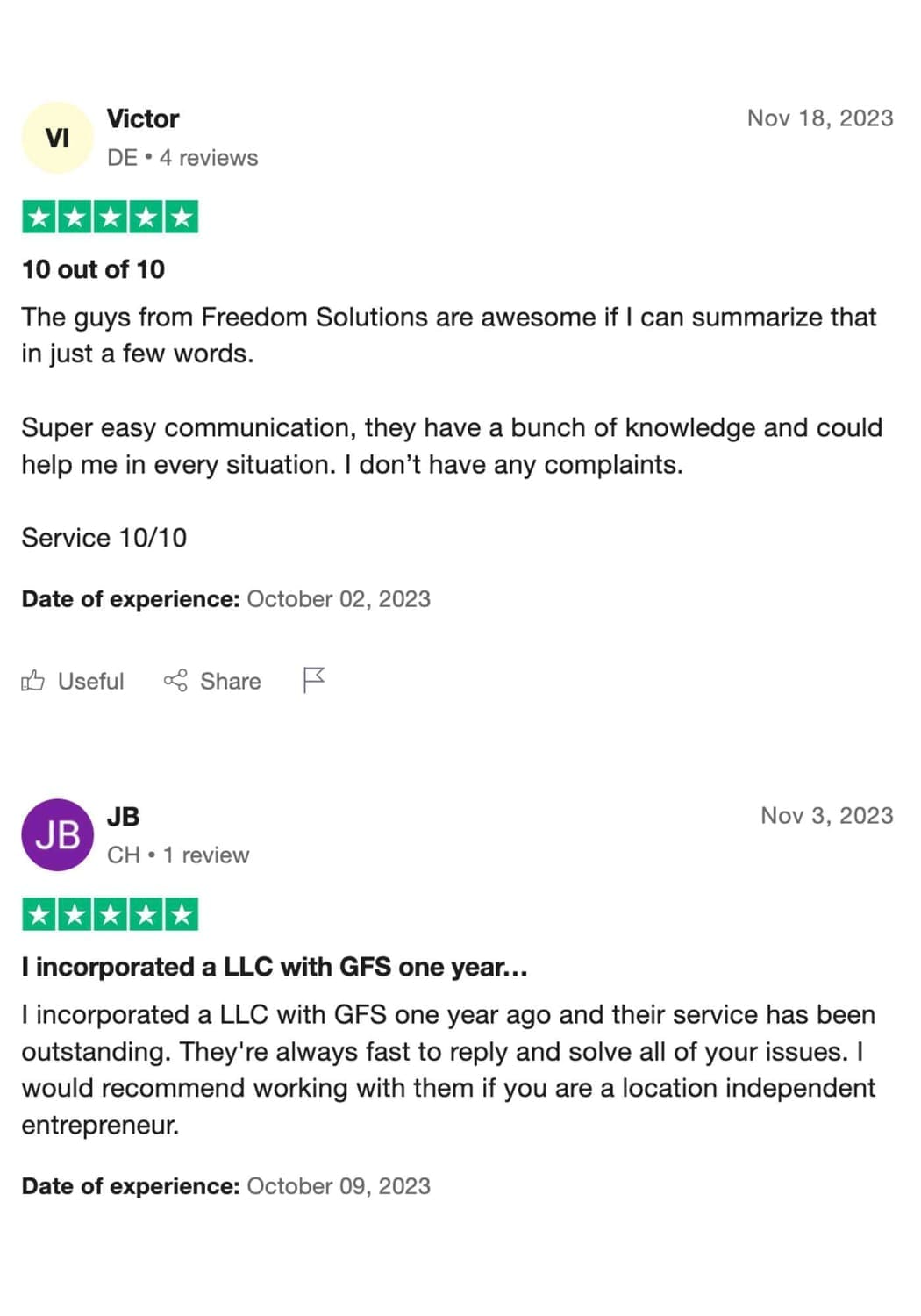

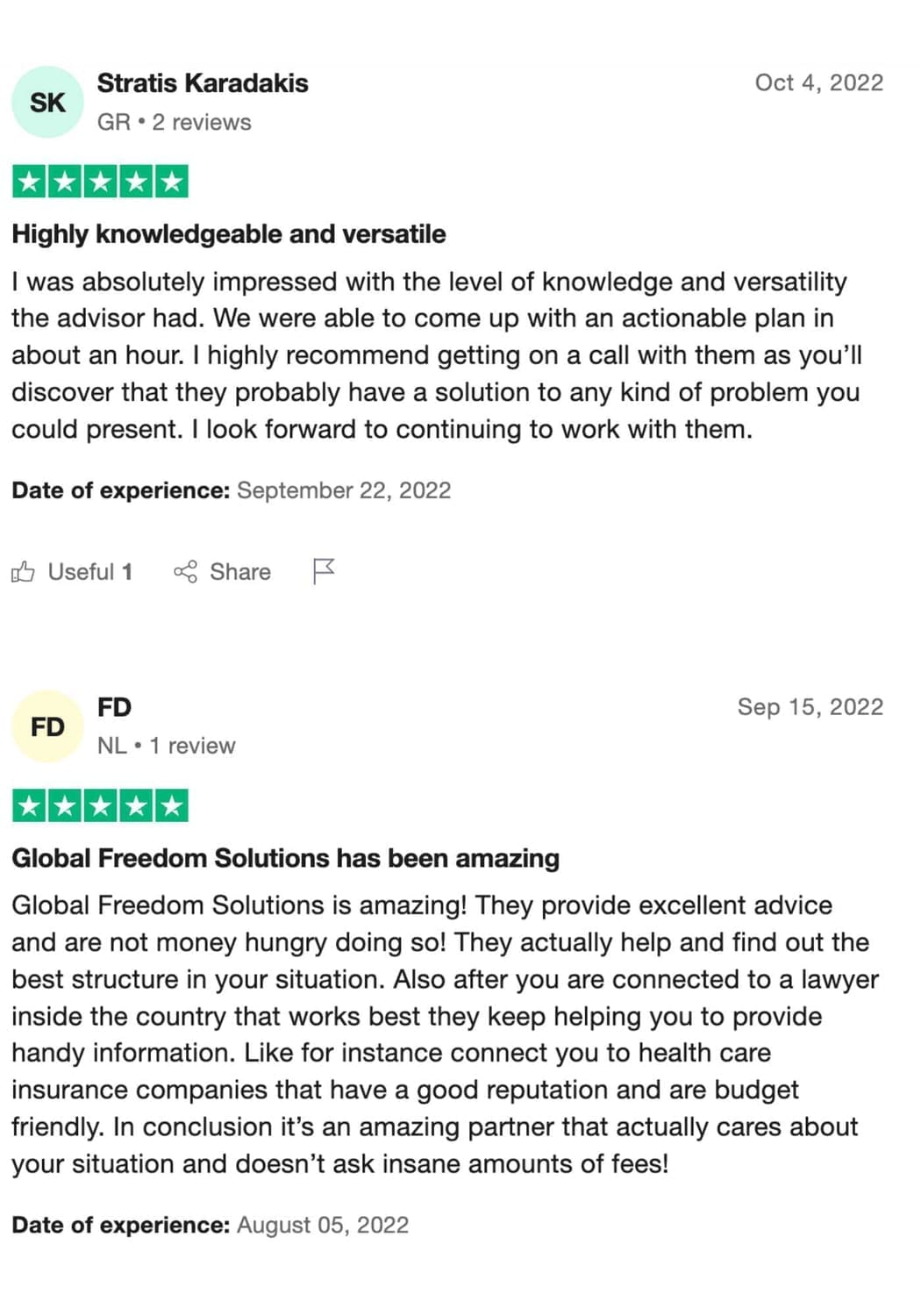

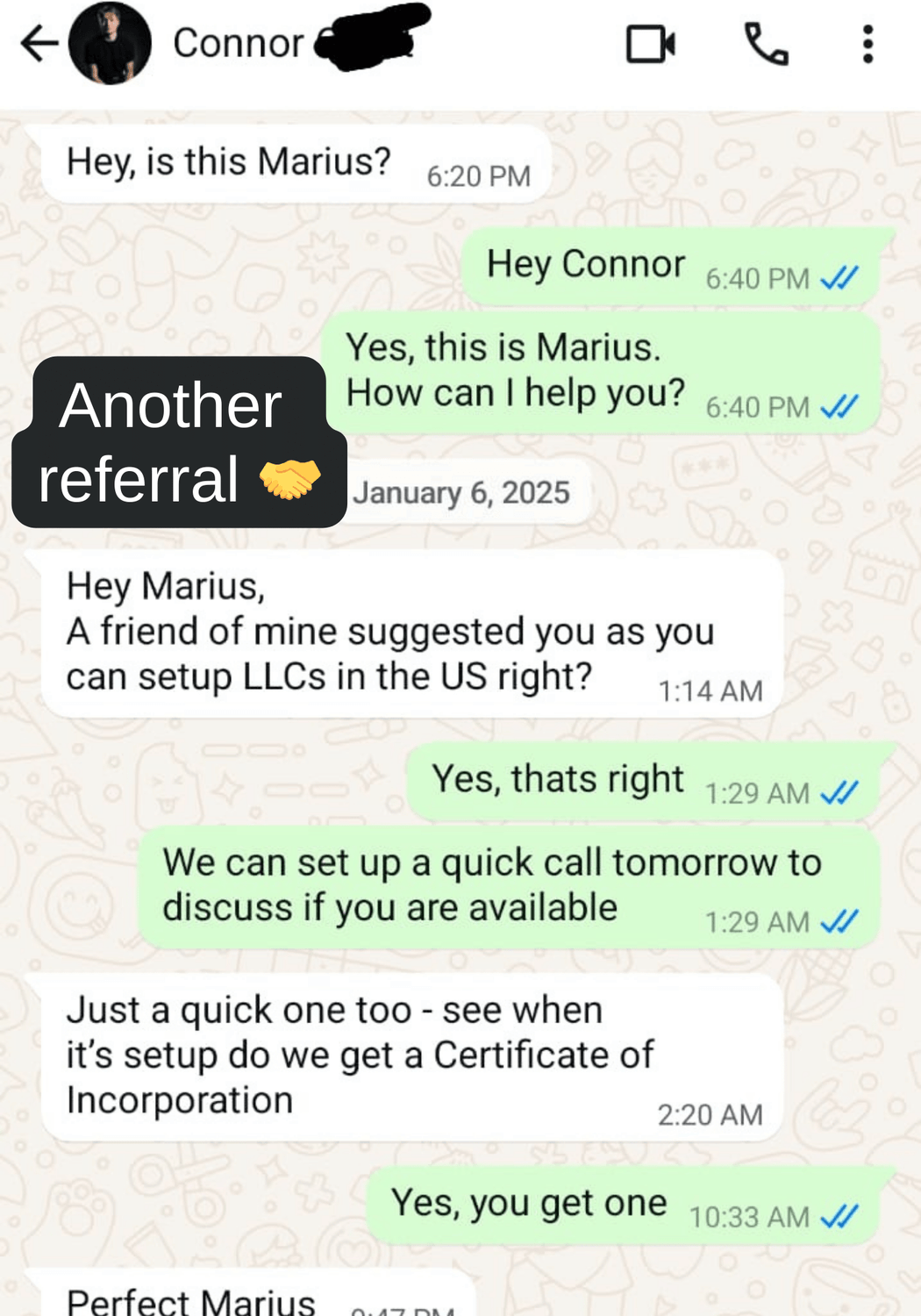

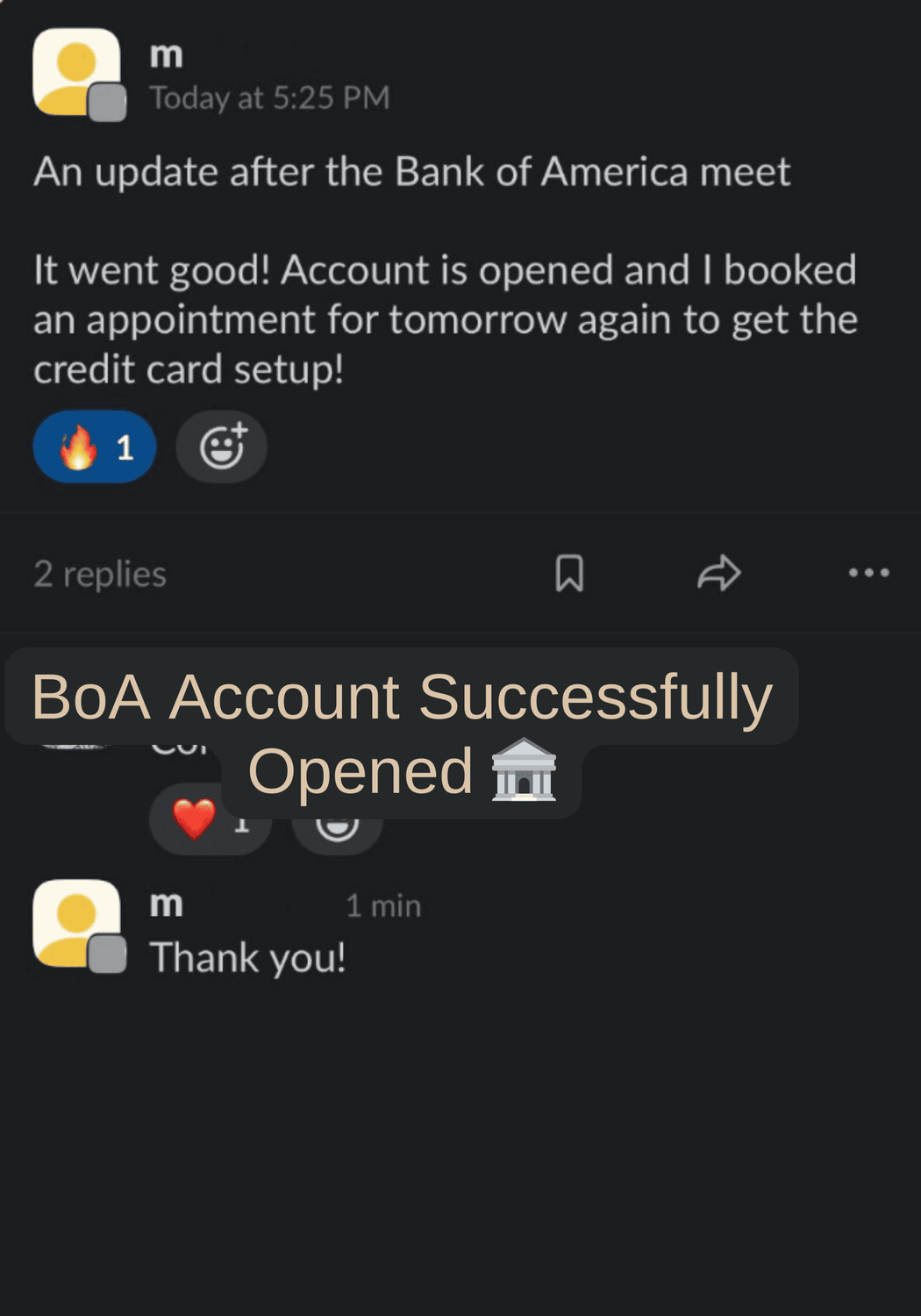

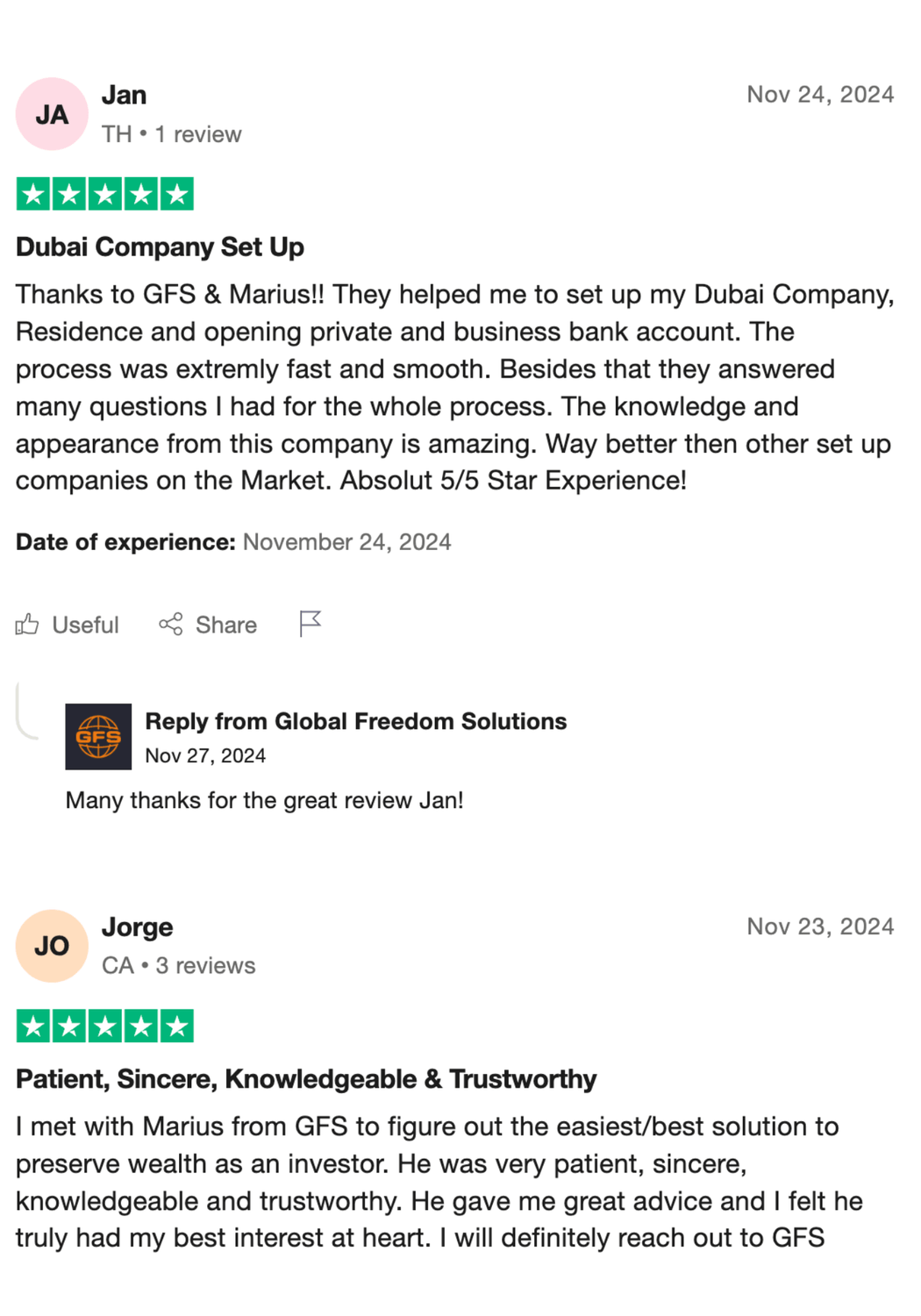

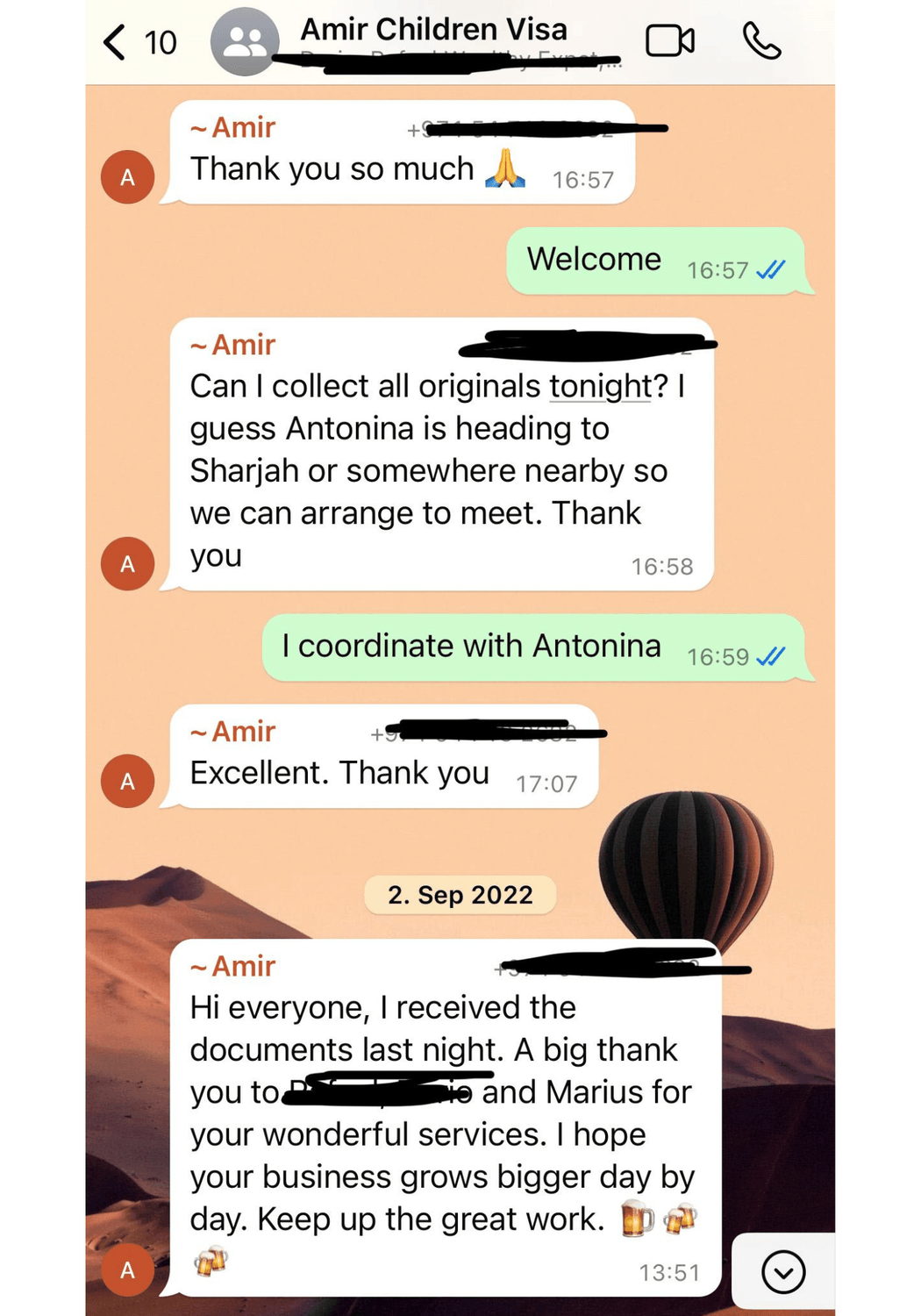

See What Our Happy Clients Are Saying.

Common Questions

We work with entrepreneurs, investors, freelancers, and digital nomads who run online or international businesses and want to reduce taxes, protect assets, and expand globally.

Our pricing depends on your specific situation and the services you need (company formation, banking, residency, tax optimization, etc.). We believe in transparent, all-in pricing with no hidden fees. After your free consultation, you’ll receive a clear proposal so you know exactly what to expect before moving forward.

Yes. Everything we do is 100% legal and compliant. We use proven international structures — no hacks, no loopholes, no shady tricks.

We specialize in the most attractive global business hubs such as Dubai, USA, UK, Cyprus, and Hong Kong — but we also support additional jurisdictions depending on your needs.

Not necessarily. In some cases you can keep living where you want while running your business through an international structure. If relocation or a residency visa makes sense, we’ll guide you through the process.

Yes. We help clients access international banking and top-tier credit cards, so you can manage your business and personal finances globally. We place great emphasis on asset protection.

It depends on your business model, revenue, and personal situation. That’s why we start with a free consultation to analyze your case and recommend the best structure for you.

In some jurisdictions (like Dubai or the US), you can have your company set up and bank account ready within a few weeks. Other structures may take a bit longer — but we always aim for a smooth, fast, and efficient process.

Reserve your spot

Lorem ipsum dolor sit amet, consectetur, numquam enim ab voluptate id quam.

We HATE spam. Your email address is 100% secure