Open & Keep US LLC Bank Accounts (Even as a Non-Resident)

Our proven US LLC Banking Blueprint shows you exactly how to open and keep accounts with fintechs and even major banks like Chase & BoA.

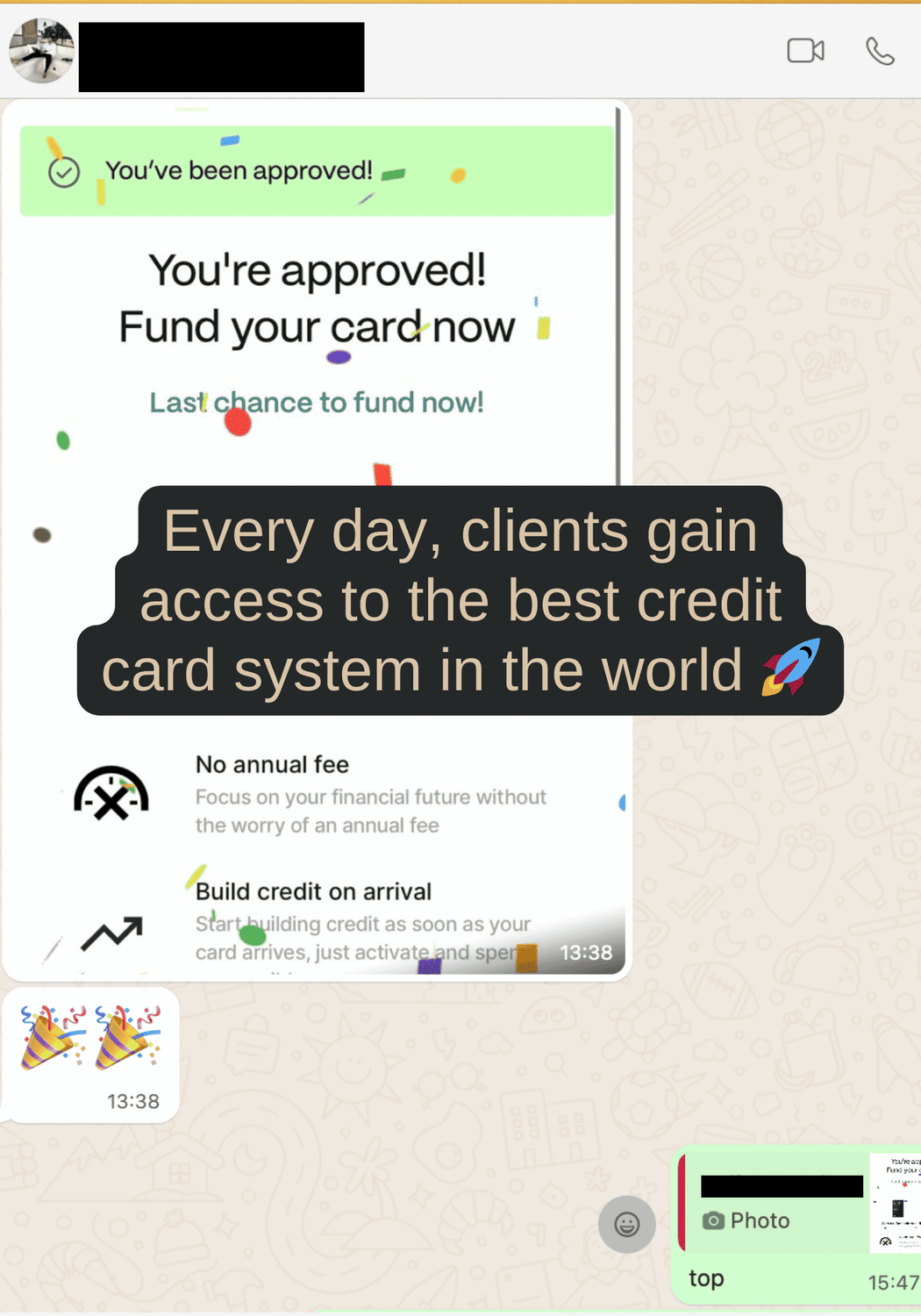

Bonus included: Complete US Credit Building Guide - strategies worth thousands.

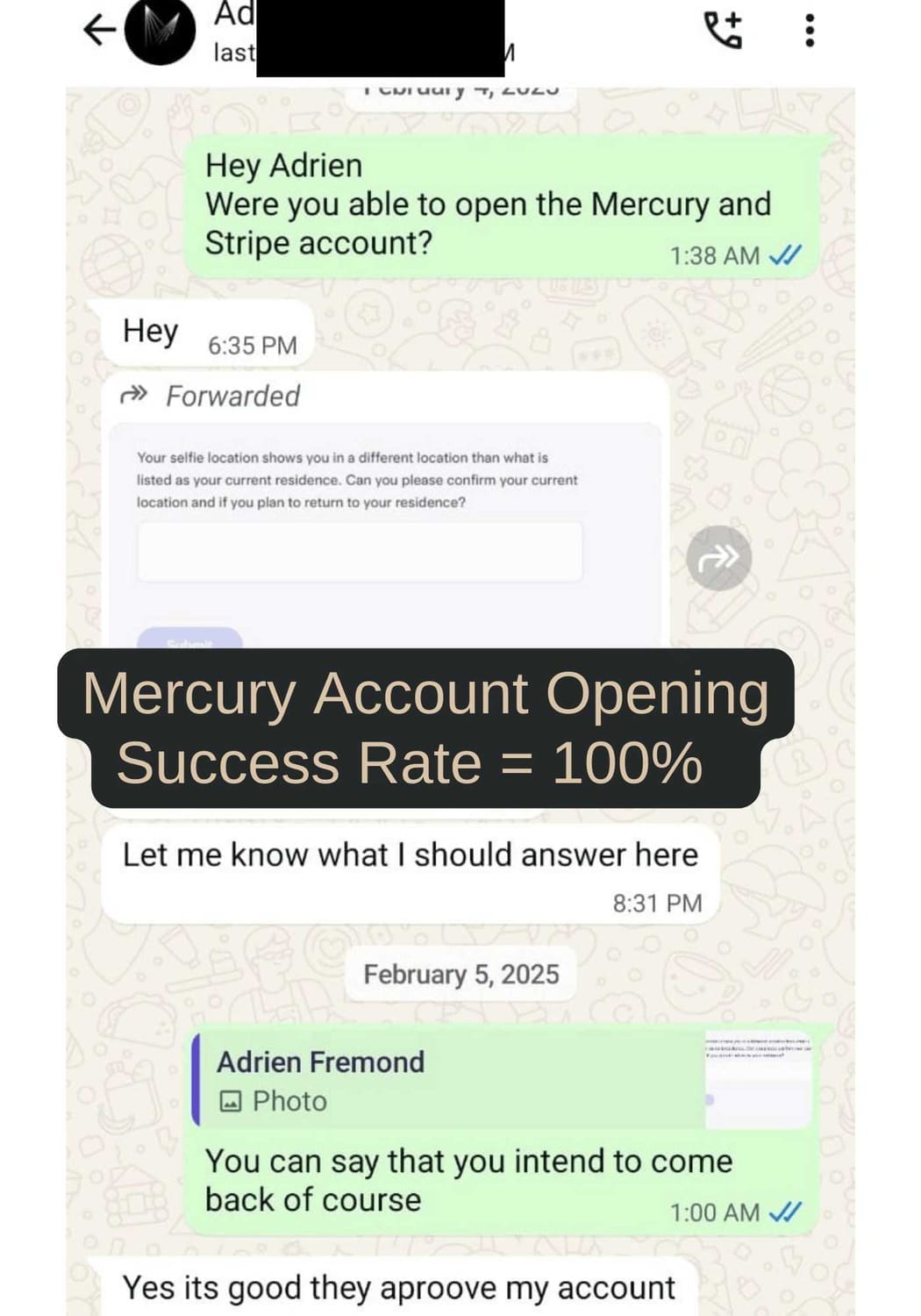

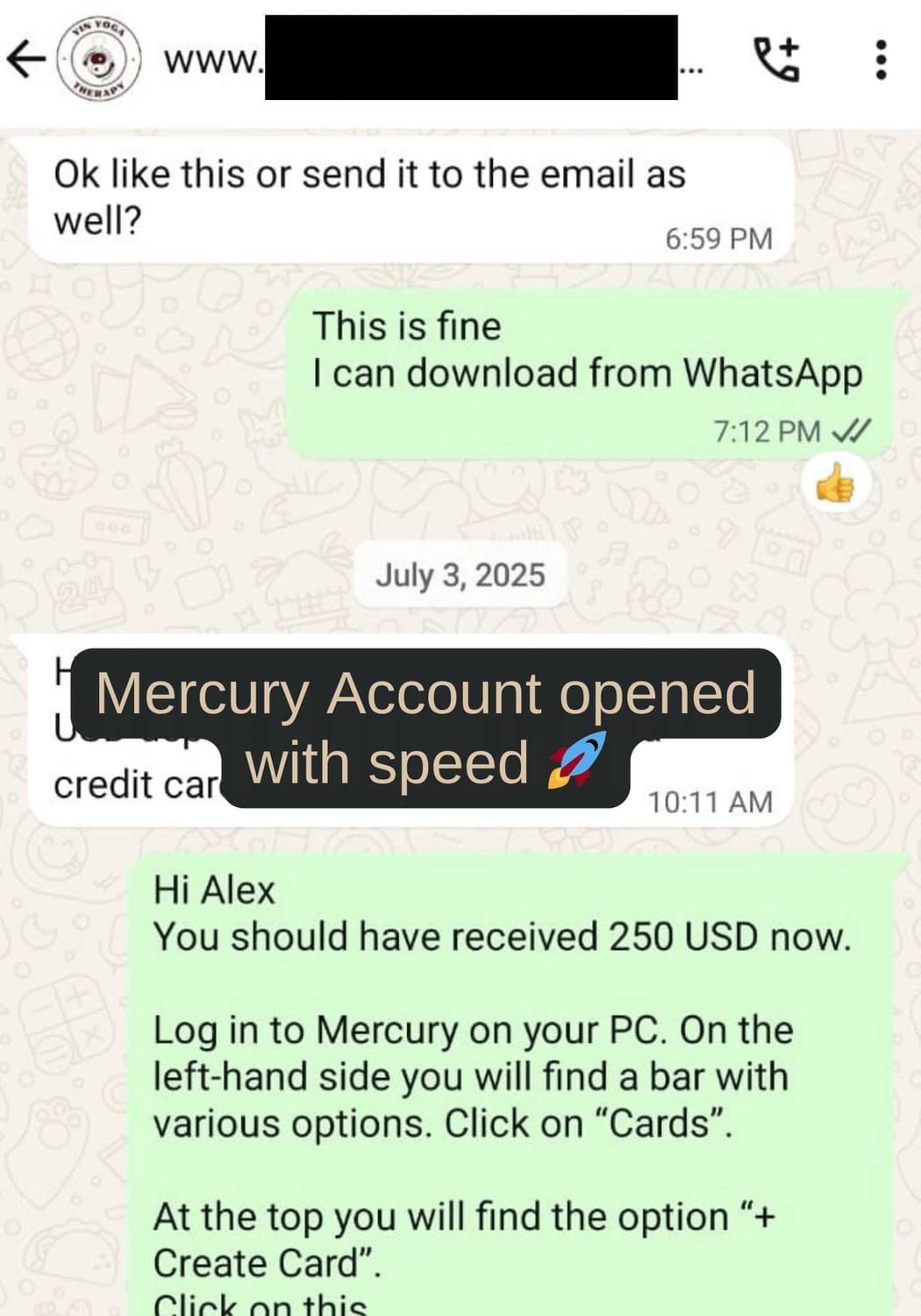

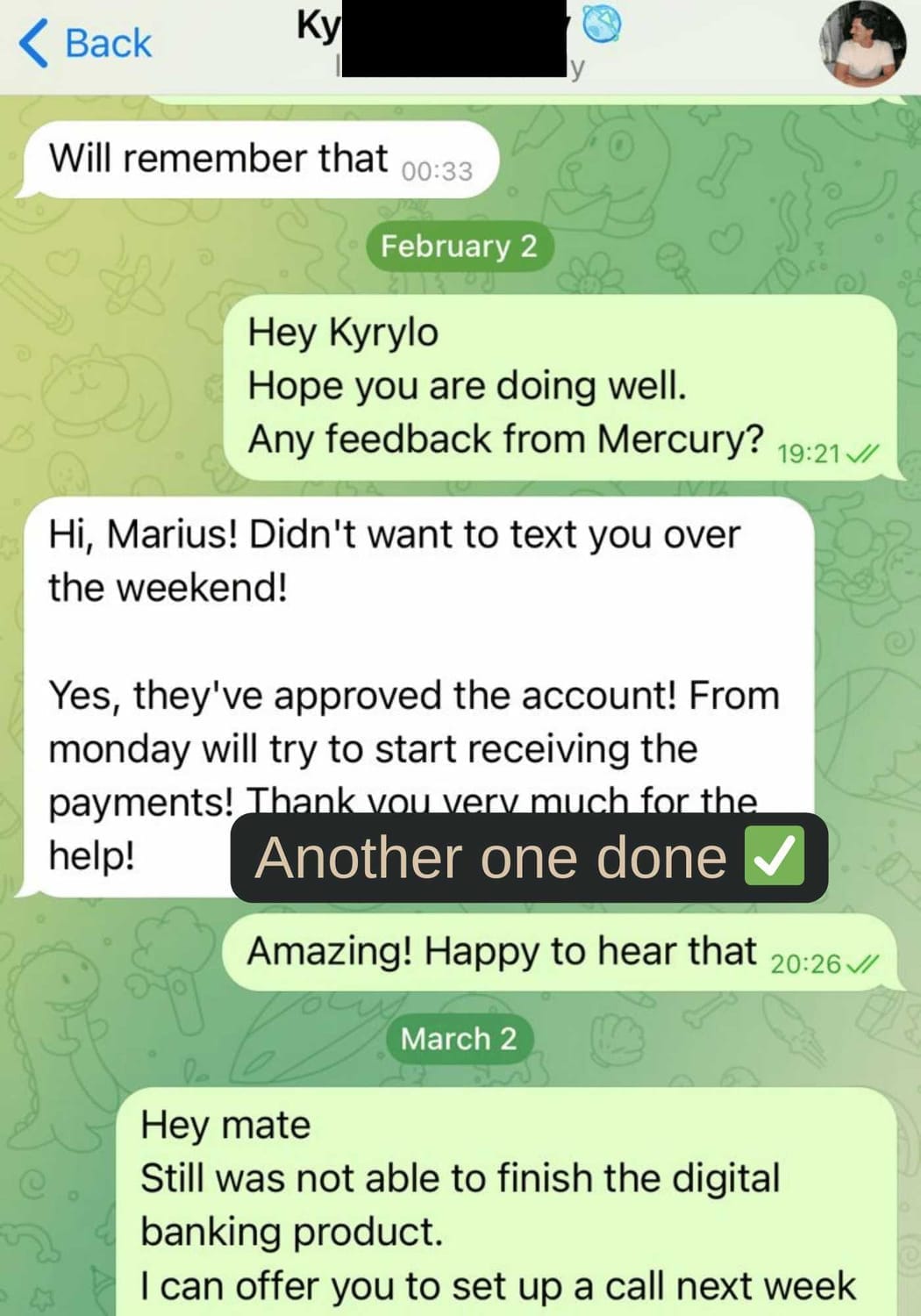

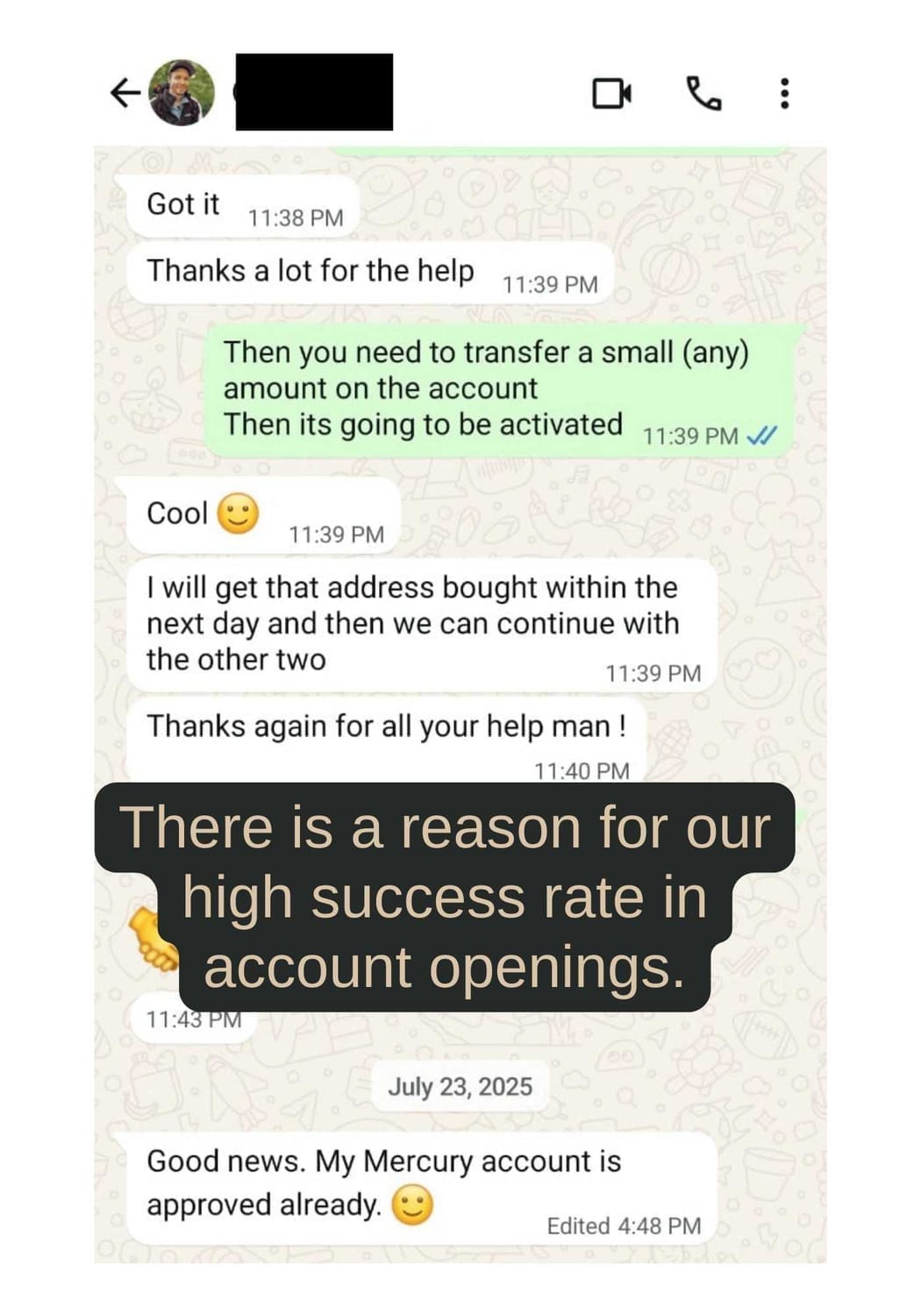

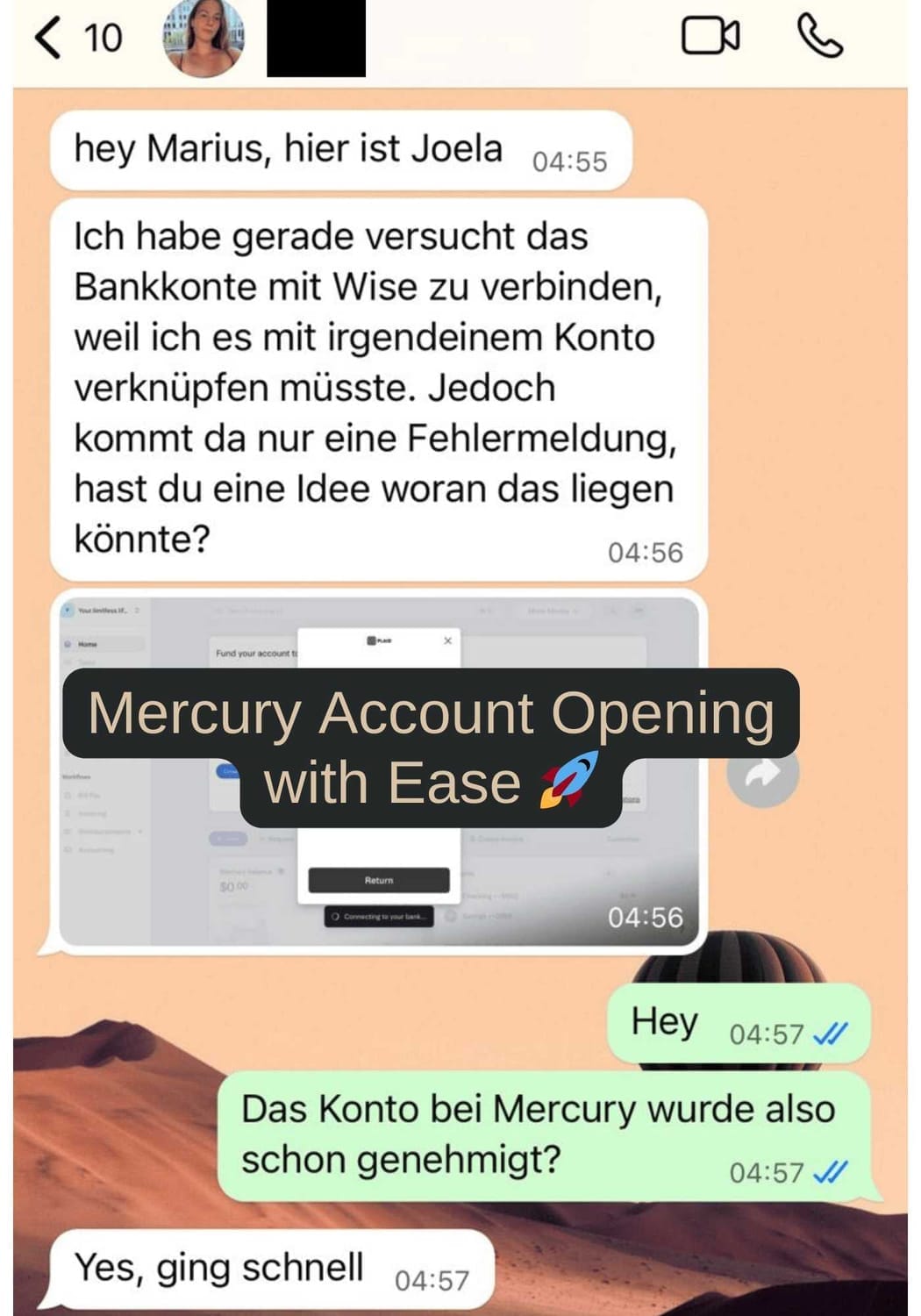

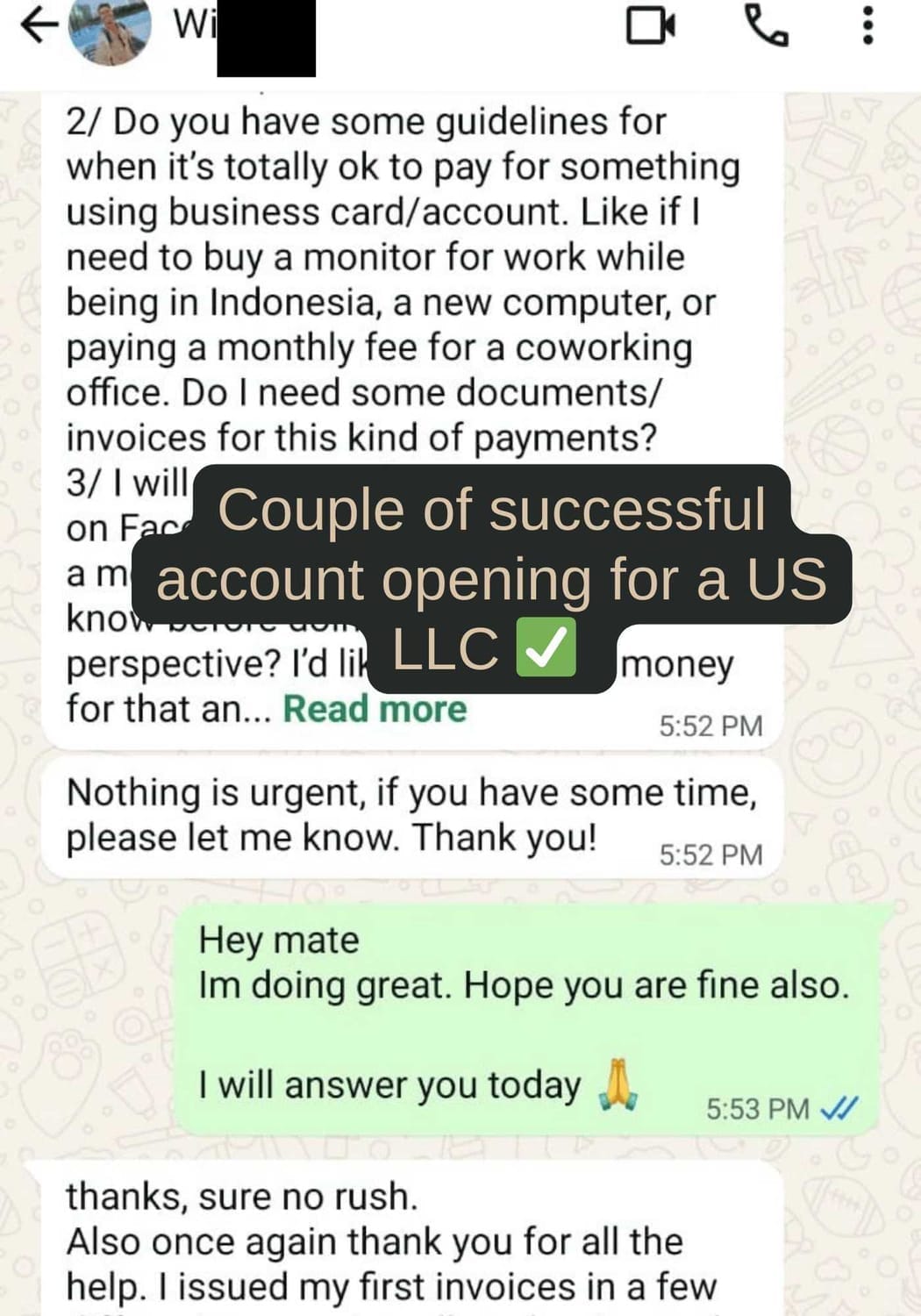

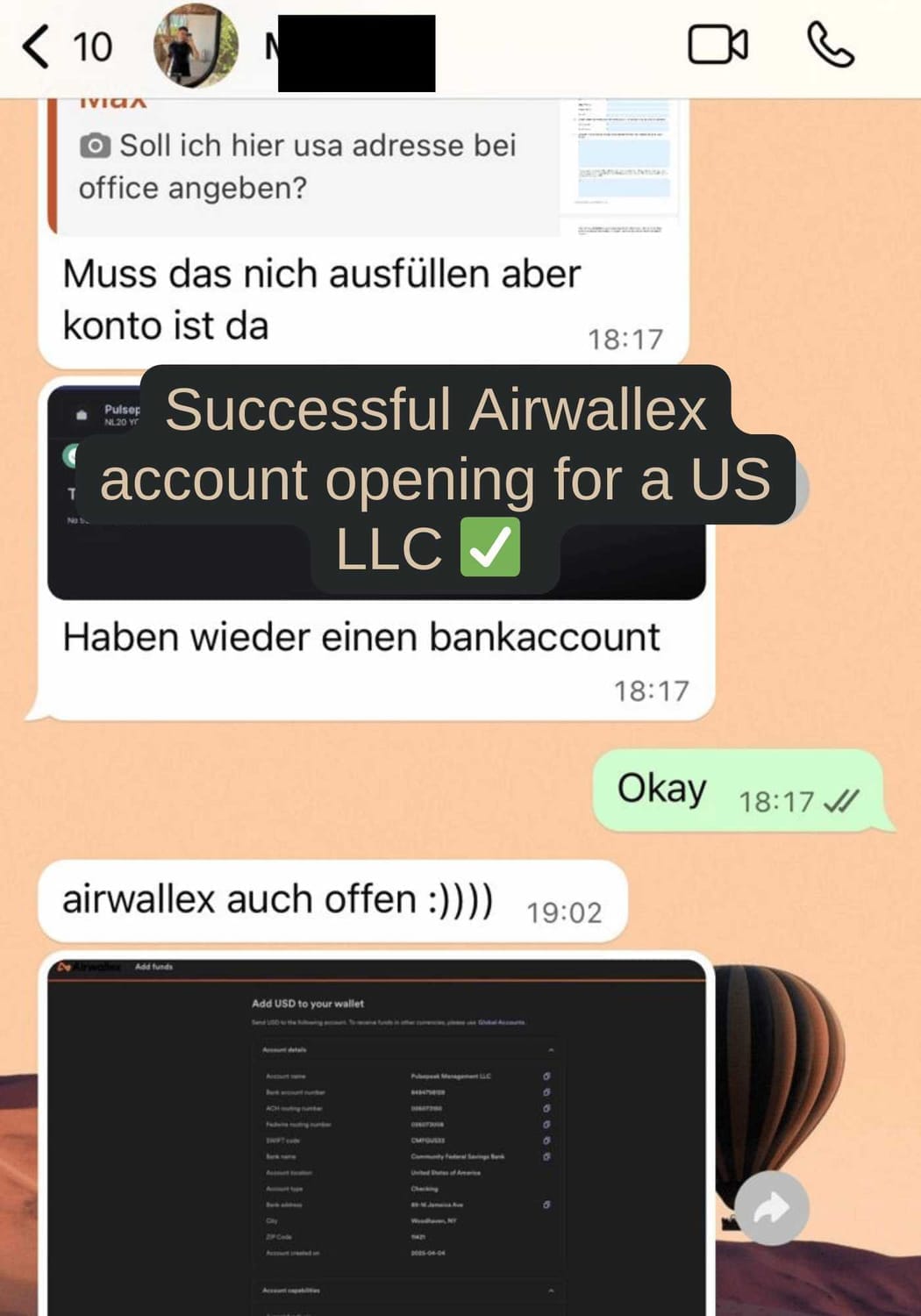

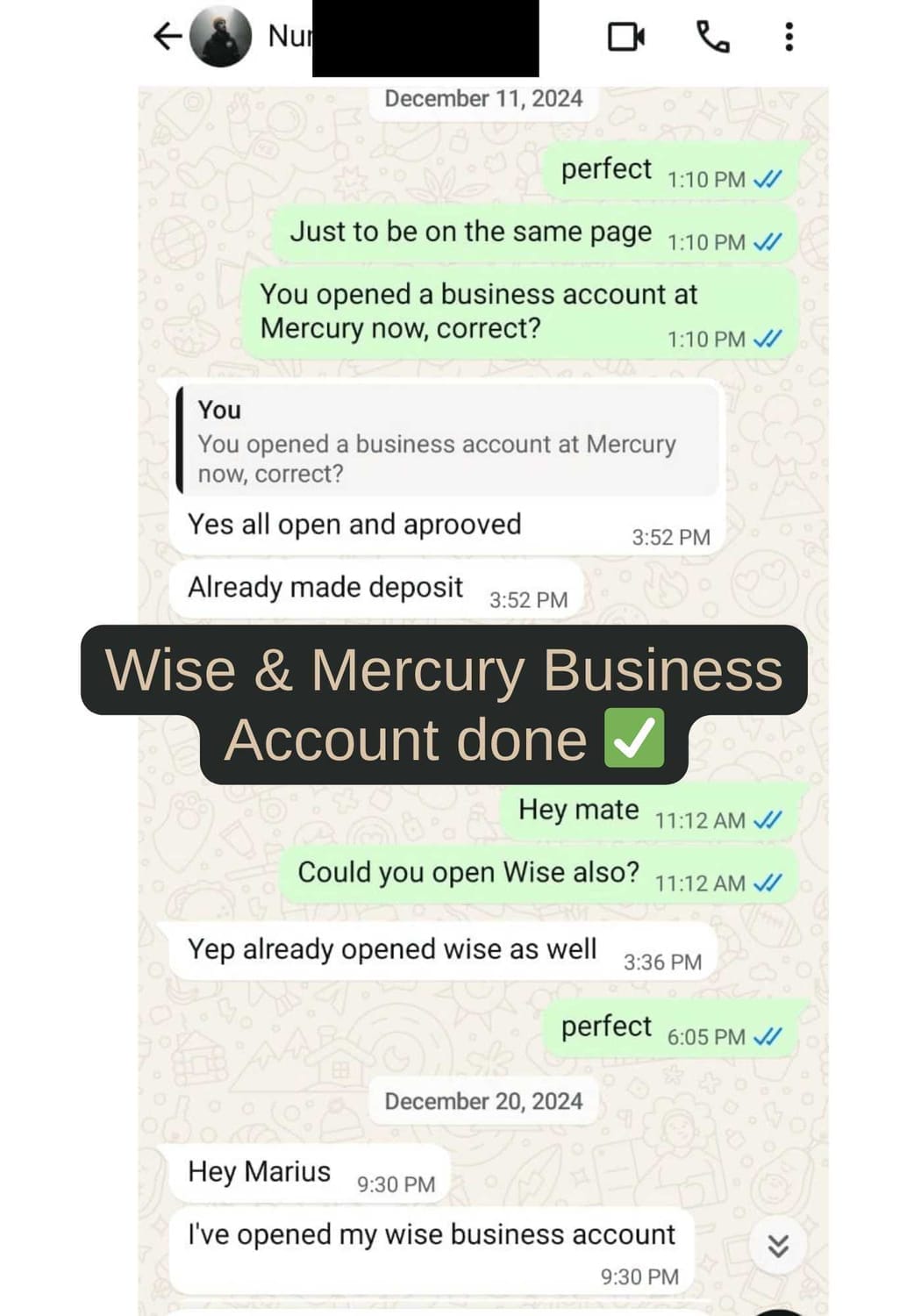

Real Results For Over 3,700 Clients Globally

Why Most Nonresident US LLC Owners Fail at Banking (and How to Fix It)

See if any of this sounds familiar…

NO REAL OPTIONS?

You’re stuck depending on 1–2 potentially unreliable options like Wise or Revolut, never knowing if they’ll last.

REJECTED AGAIN?

You apply at Mercury, Wise or Relay — only to get rejected instantly or closed weeks later.

ALWAYS WORRIED?

You live in fear that your hard-earned account will suddenly get flagged or frozen without warning.

BIG BANKS FEEL IMPOSSIBLE?

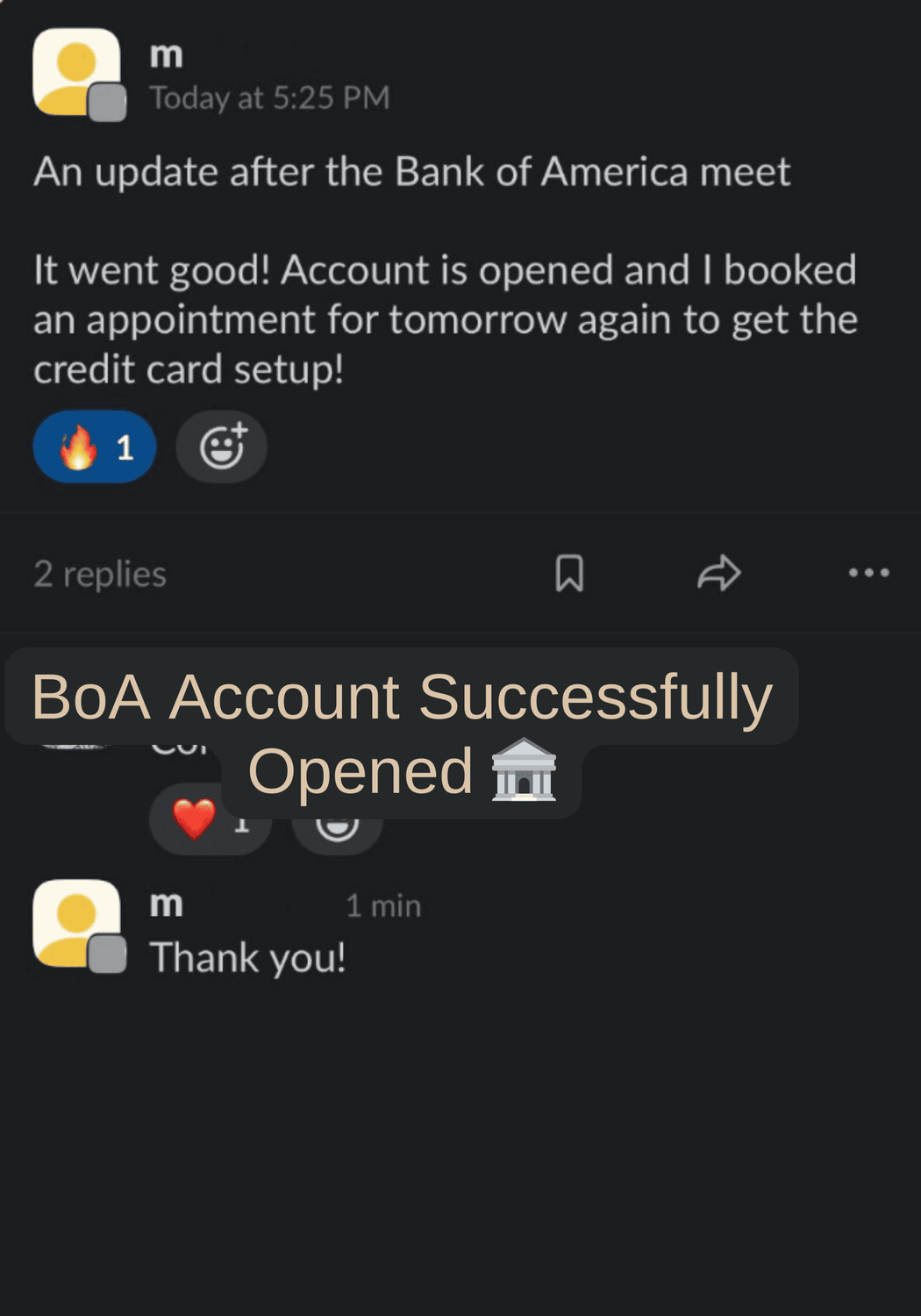

You have no clue how to open accounts with Chase, Bank of America or other major US banks as a nonresident.

You’re not alone. Most nonresident US LLC owners face this. The Banking Blueprint shows you how to finally open & keep accounts — and unlock US credit cards.

⛊ Secure checkout – 14-day money back guarantee

⛊ Secure checkout – 14-day money back guarantee

Finally — A Real Solution to Your US LLC Banking Struggles

You’ve tried every fintech — only to get rejected or shut down weeks later. Or you just don't know how to apply.

You’ve wasted hours on Reddit & YouTube, only to end up more confused.

And when it comes to high-street banks like Chase, Citi, or Bank of America, you don’t even know where to start without being shown the door.

Enough.

You’re not alone — most nonresident US LLC owners face the same roadblocks. The US LLC Nonresident Banking Blueprint gives you the exact steps to finally open and keep reliable accounts, without endless guesswork.

No guesswork. No outdated hacks. Just a proven path that works — step by step.

Who It's For

The Digital Nomad

You run a US LLC from abroad — and want a reliable banking setup that truly fits your lifestyle.

The Remote Business Owner

You sell online services worldwide — but you’re unsure how to get proper US banking.

The Non-Resident Entrepreneur

You don’t live in the US and want a clear path to open and keep business accounts.

The Cautious Applicant

You’ve looked into Mercury, Wise, or Revolut — but don’t want to risk mistakes or closures.

⛊ Secure checkout – 14-day money back guarantee

⛊ Secure checkout – 14-day money back guarantee

The All-in-One Guide to Banking with a US LLC — for US Nonresidents

Learn how to open and keep business accounts — with both fintechs and traditional US banks like Chase or Bank of America. Tailored for digital nomads and US LLCs.

Get access to a comprehensive list of banks and EMIs that accept US Non-Resident founders.

All vetted, categorized, and ready to use.

Understand how to answer typical KYC questions. What to SAY, and what NOT to SAY.

Avoid red flags and get your accounts approved faster.

Build real US credit as a non-resident. Get access to top-tier cards like Amex Gold & Chase Ink — step by step. Use those points to fly Business or even First Class for almost free.

Why This Works When Others Don’t

Most non-resident US LLC owners hit the same wall.

You’ve got the company… now what?

Conflicting advice. Outdated info. No clear path.

Forget paying hundreds for vague “consulting calls.”

Follow a proven, step-by-step system that works for non-resident US LLC owners.

We’ve tested dozens of banks and fintechs — Mercury, Wise, Revolut, plus Chase, Citi, Bank of America.

We know what works, what doesn’t, and how to avoid rejections.

Get approved faster.

No guessing. No wasted time.

Most non-resident US LLC owners hit the same wall. You form the company, you’ve got the documents… and then you’re left asking, “Now what?” You search online, get conflicting advice, and quickly realize that nobody is giving you a clear, step-by-step path that actually works for founders outside the US.

Sure, you could book “consulting calls” for hundreds — sometimes even thousands — of dollars just to get vague answers and a few links you could have found yourself. But why waste that kind of money when you can follow a proven, easy-to-implement system that already works for entrepreneurs just like you?

Our approach is straightforward, fast, and designed so you can take action right away — without waiting weeks for replies or throwing money at overpriced middlemen. This isn’t theory. This is practical, tested, proof-of-work material that has helped countless US LLC owners open accounts with both fintechs like Mercury, Wise, and Revolut and high-street US banks like Chase, Citi, and Bank of America.

This isn’t a generic “LLC checklist” you could Google.

It’s a laser-focused system built for one purpose: helping non-residents open real, long-term US business accounts.

We’ve done the trial and error so you don’t have to.

We’ve tested dozens of banks and fintechs.

We’ve learned exactly what triggers rejections — and how to avoid them.

And the best part? You can go from “I have no idea where to start” to account approved without expensive calls, without endless guessing, and without the painful dead ends most founders experience.

⛊ Secure checkout – 14-day money back guarantee

⛊ Secure checkout – 14-day money back guarantee

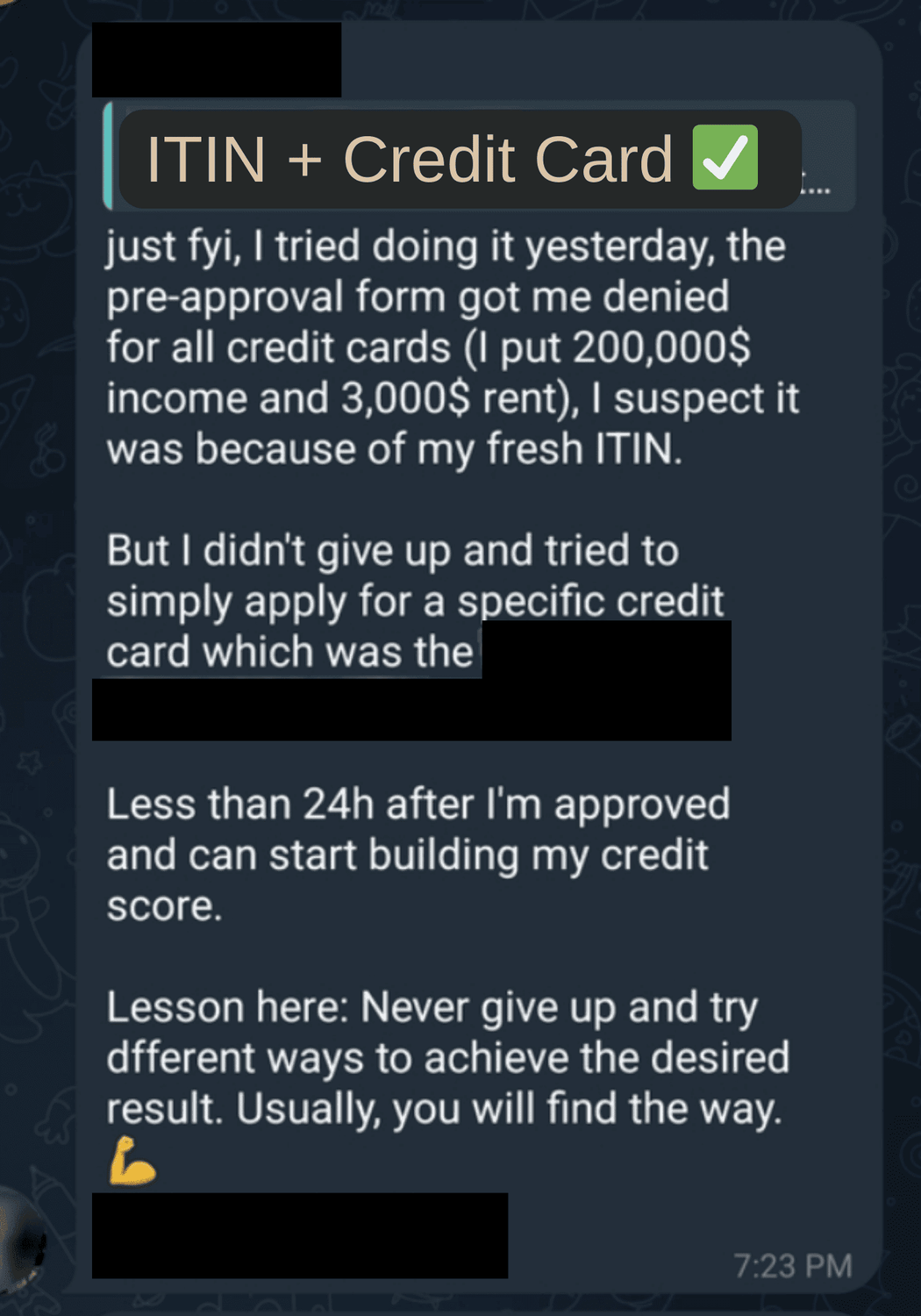

✅ BONUS – US Credit Building Guide

Most non-residents think US credit is impossible without living in the States.

Wrong.

Other “consultants” charge high four to five figures for this information — selling it as if it’s rocket science. It’s not. We’re giving it to you as a bonus.

Inside, we show you step-by-step exactly how to:

Build a real US credit profile from anywhere in the world

Qualify for premium US credit cards like Amex Gold or Chase Ink

Tap into rewards, Cashback, and travel perks that far outperform credit cards in most other countries — including up to 4–5x points per $1 on expenses like ad spend, travel, dining, and groceries

Use those points to fly Business or even First Class for almost free, and stay at top hotels on points

The reward systems on these cards are unmatched — and now you’ll know exactly how to access them.

We have compiled all our knowledge about US credit building in a guide and are giving it to you FOR FREE.

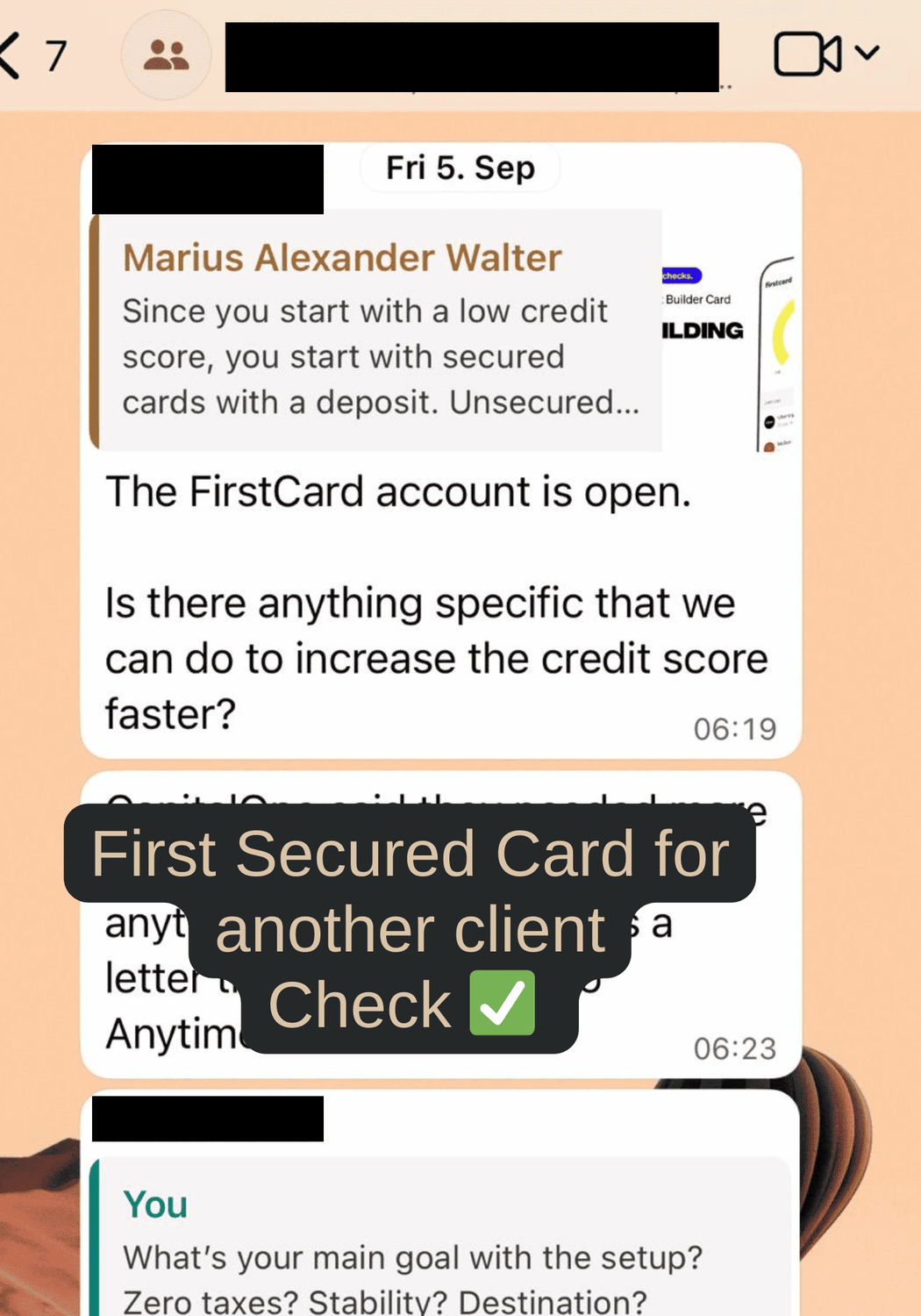

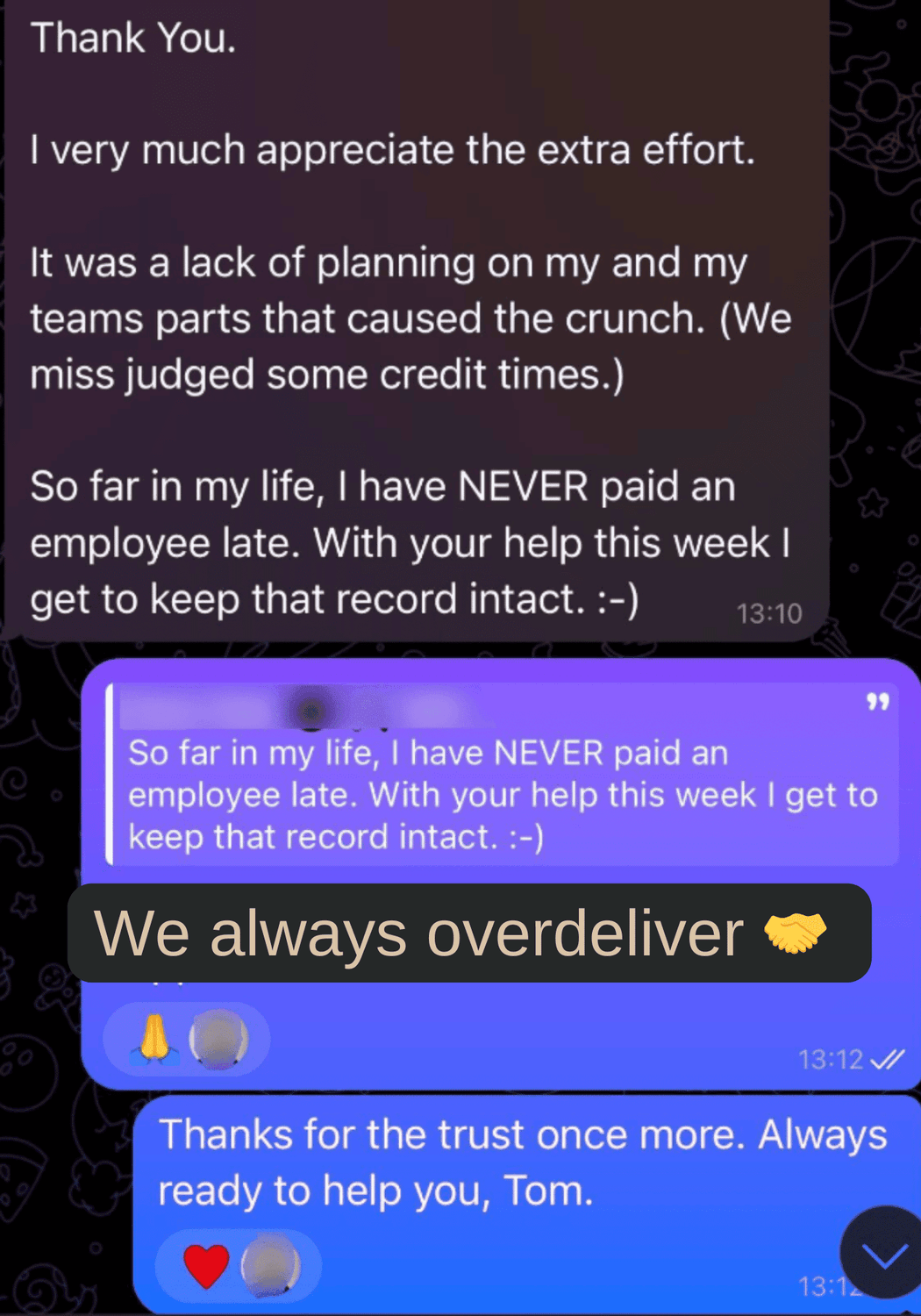

Real Results.

Real Approvals.

Experts in Banking.

WHO IS GFS AND WHY YOU SHOULD LISTEN TO US?

Global Freedom Solutions (GFS) was founded by Marius Walter, a former KPMG consultant with extensive expertise in international banking, compliance, and tax structures.

He has helped hundreds of digital nomads and online founders form US LLCs and open bank accounts.

With insider knowledge of how banks assess risk, along with direct contacts in fintech and banking, GFS provides proven tools to help you avoid account rejections, closures, and compliance pitfalls.

Global Freedom Solutions (GFS) was founded by Marius Walter, a former KPMG consultant with deep expertise in international banking, compliance, and tax structures. Over the years, he has guided hundreds of digital nomads, online entrepreneurs, and international founders through the process of forming US LLCs and securing reliable banking solutions.

Having worked directly with both fintechs and traditional banks, Marius understands exactly how financial institutions assess risk — and what it takes to pass their internal checks. Combined with direct industry contacts, this insider knowledge has allowed GFS to create practical, battle-tested tools that eliminate guesswork and dramatically reduce the chances of account rejections, sudden closures, or compliance-related issues.

At GFS, the mission is simple: give non-resident entrepreneurs the same banking opportunities as US-based founders — without the frustration, wasted time, or inflated consulting fees that dominate the industry.

Pricing

Solve Banking Fast. No Guesswork.

$147 Save $110!

Now $37

Step-by-Step Banking Guide:

Open and maintain accounts with both fintechs and US high-street banks like Chase, Citi, and Bank of America — built for non-residents.

KYC Walkthroughs:

Understand how to answer typical KYC questions.

Avoid red flags and get your accounts approved faster.

Comprehensive Database of EMIs and Full Banks:

A vetted, categorized list of institutions open to working with non-resident US LLCs.

Bonus: US Credit Building Guide

Learn how to build US credit without an SSN and unlock premium cards like Amex Gold & Chase Ink.

⛊ Secure checkout – 14-day money back guarantee

⛊ Secure checkout – 14-day money back guarantee

Expertise You Can Trust – Solutions That Deliver

At GlobalFreedomSolutions, we’ve combined years of experience in auditing, capital markets consulting, and tax optimization to create a product that delivers real-world results.

This isn’t just theory – it’s a proven system designed to help entrepreneurs, investors, and digital nomads like you overcome the most challenging banking hurdles. Every strategy, every tip, and every step in this product is grounded in the knowledge we’ve gained from solving real problems for clients worldwide.

The result? A clear, actionable plan to secure the banking solutions you need, stress-free.

Common Questions

This product is designed for:

Online Entrepreneurs: Especially those using popular structures like US LLCs and UK LLPs, but applicable to other international company types as well.

Digital Nomads: Entrepreneurs without a fixed residency, needing banking solutions that cater to their unique lifestyle.

E-Commerce and Digital Business Owners: Looking for reliable and diversified banking options to avoid account closures or issues.

Investors and Freelancers: Seeking secure, flexible banking solutions for their international financial operations.

Global Entrepreneurs: Anyone operating across borders who needs to ensure smooth, compliant banking setups.

High risk industry businesses such as Adult Entertainment, Crypto, Gambling etc.

Businesses with high chargeback rate such as dropshipping

If you're an online entrepreneur struggling with banking, especially with US LLCs or UK LLPs, this product is tailored for you!

This product is designed for online entrepreneurs, especially those using US LLCs and UK LLPs, but it can be useful for any international business structure.

Yes! Our guide helps you navigate the KYC process even if you don’t have a local residency, which is often a challenge for digital nomads and online entrepreneurs.

EMIs (Electronic Money Institutions) offer financial services like bank accounts but aren’t full-scale banks. Our guide helps you understand when to use each for your business needs.

The database includes detailed information on banks and EMIs that are friendly to online entrepreneurs, particularly for those operating with international business structures like US LLCs and UK LLPs.

Yes, in some cases we provide contacts to representatives at EMIs or full-scale banks, giving you a direct line to streamline the account opening process.

Yes, the guide provides a comprehensive overview of what to consider during the KYC process. It includes common questions that banks typically ask, along with guidance on how to respond adequately to avoid raising compliance red flags. Providing false or inaccurate information can frequently lead to rejections or ongoing issues with the bank, so our guide helps you navigate this critical aspect effectively.

The product is designed to help you avoid common pitfalls in the account opening process, and we also offer diversification strategies to reduce your risk by spreading accounts across multiple solutions.

Absolutely! Digital nomads particularly benefit from this product, as they often face the most significant challenges with EMIs and banks. Many rely solely on 1-2 solutions, like Wise or Revolut, but accounts can be frozen much more quickly than they realize. Our product provides the necessary tools and insights to help digital nomads find diverse and reliable banking options, ensuring they can operate smoothly while managing their business.

Yes, absolutely! Our product is designed to assist entrepreneurs in navigating the challenges of banking from locations that are often viewed as high-risk by EMIs and banks, including Dubai. We provide insights and strategies specifically tailored to help you overcome common barriers, ensuring that you can successfully open and maintain accounts despite your location.

⛊ Secure checkout – 14-day money back guarantee

⛊ Secure checkout – 14-day money back guarantee