Attention, Digital Nomads and Online Entrepreneurs!

Set up a US LLC...

...and legally reduce your taxes to 0% - within 4 weeks.

Step 1 of 2: Watch Video To Learn How 👇

Step 2 of 2: Book a Free Discovery Call to Open Your US LLC 👇

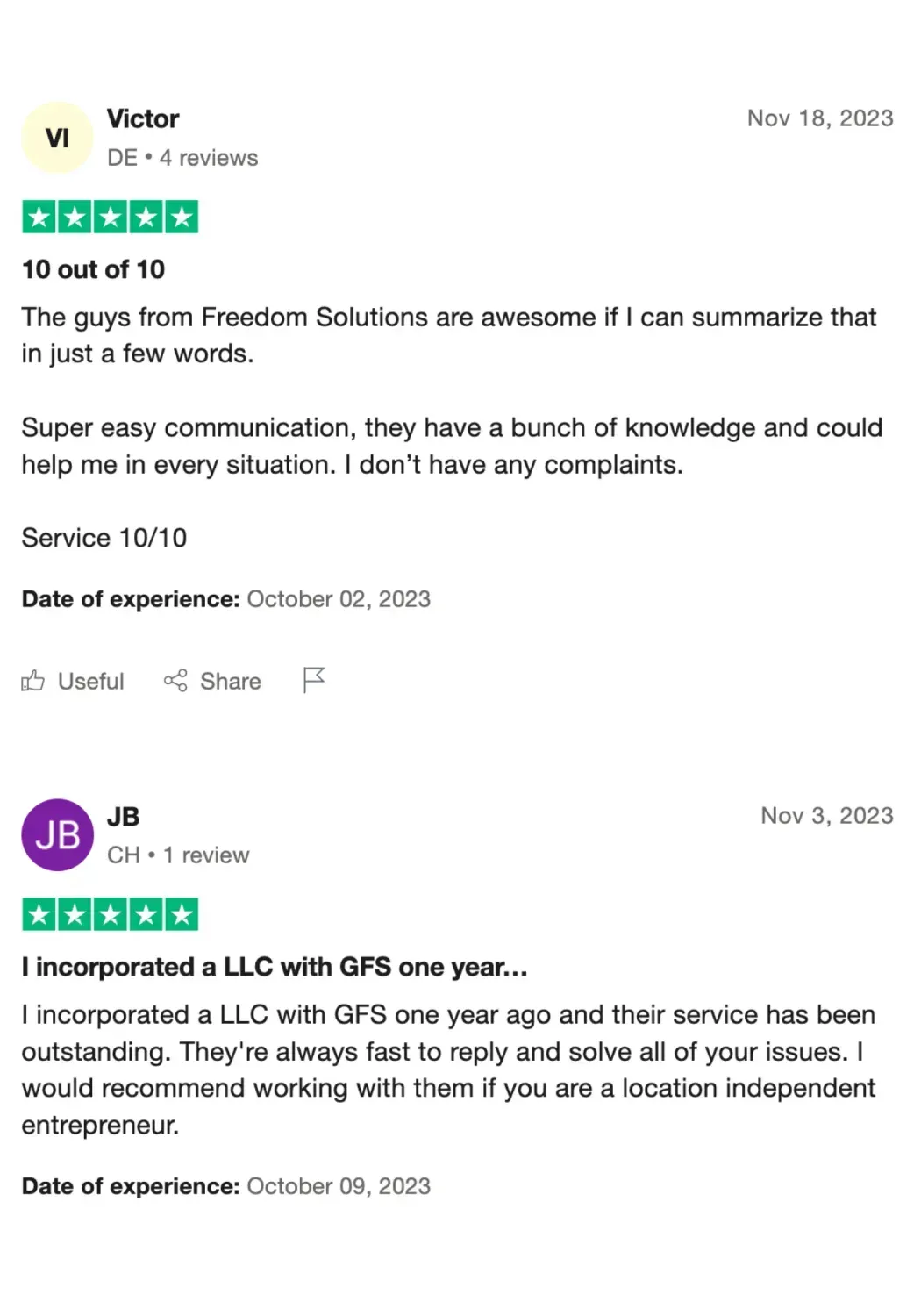

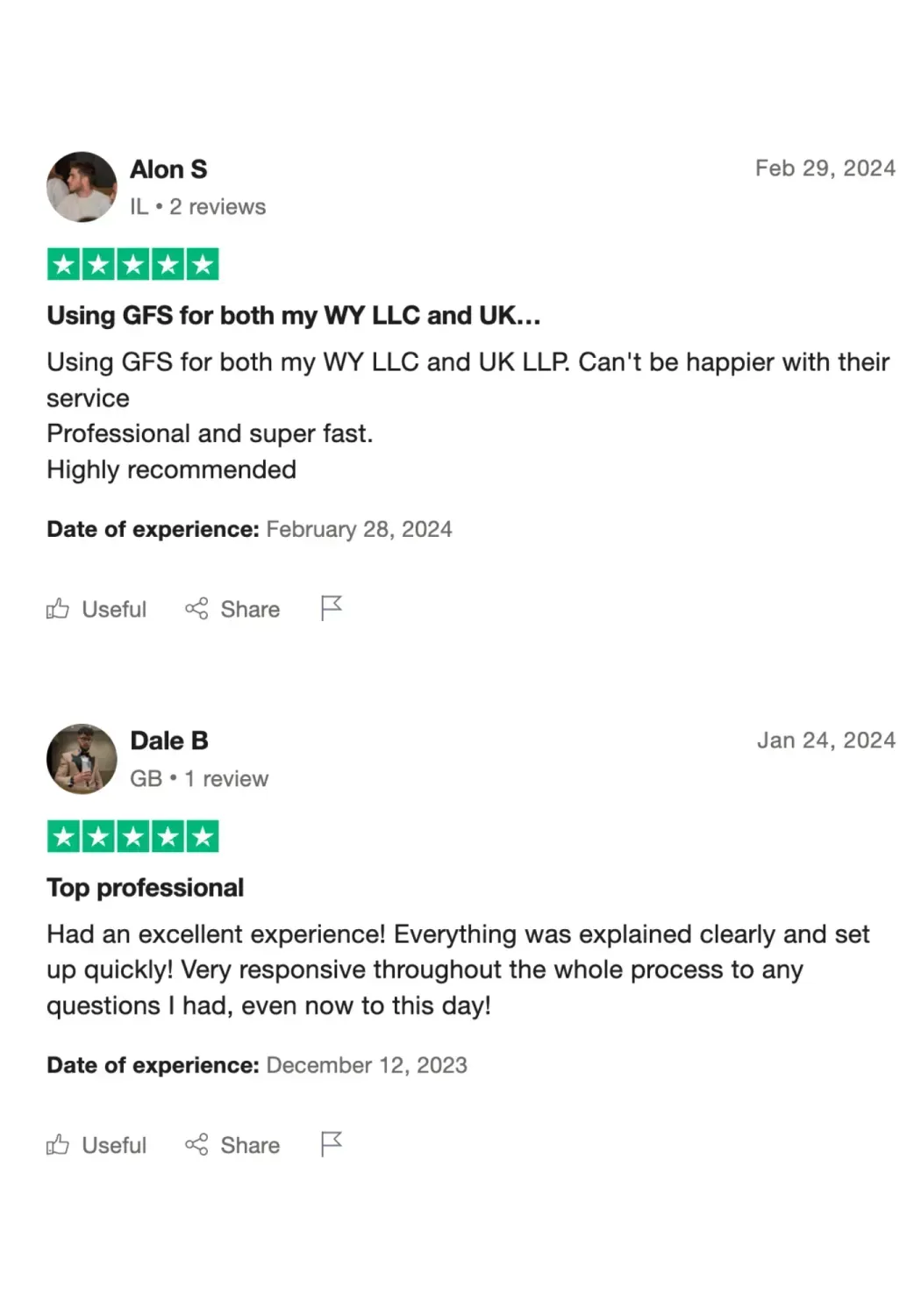

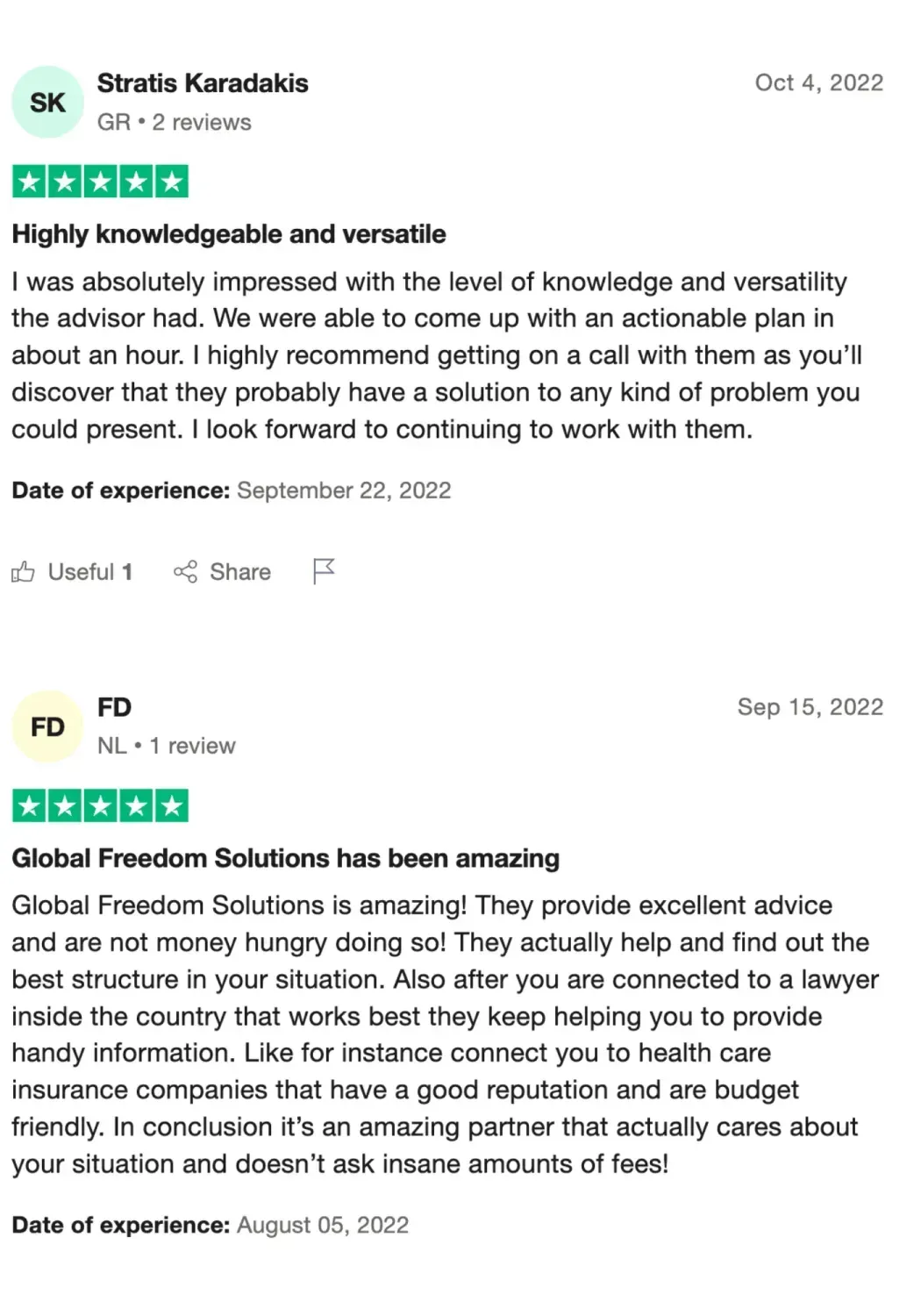

Trusted by 250+ entrepreneurs • Rated 4.6/5

Name

Phone

What kind of business are you running?

ⓘ After you submit:

We review your application

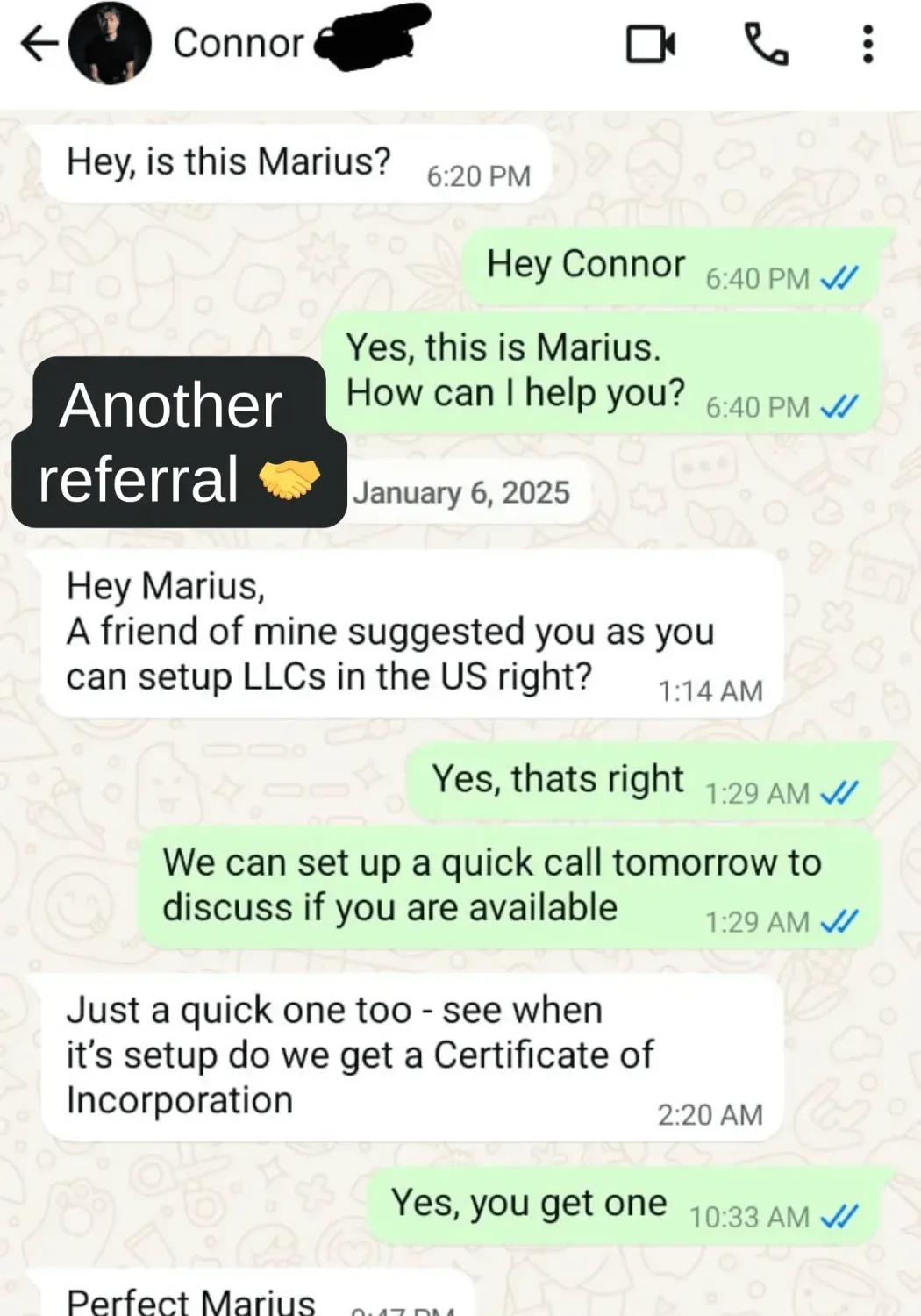

You get a WhatsApp message from us

You pick a time for your free discovery call

We walk you through your exact tax-free structure

More than

0 clients

legally pay 0% taxes now with this setup.

Legally stop paying unnecessary TAXES.

No more complex BOOKKEEPING. Fully focus on your business.

Access the best CREDIT CARDS in the world and gather miles.

Your personal assets are fully PROTECTED.

Dear Digital Nomads & Online Entrepreneurs…

Marius Alexander Walter - Founder GFS

You've built your online business with hard work, vision, and the desire for freedom. But if you're still paying taxes like someone tied to a single country — you're missing out on one of the most powerful strategies available to you.

The truth?

If you’re a non-US resident with an online business — you could legally pay 0% tax using a US LLC setup. No, this isn’t a loophole or a hack — it’s a clean, proven structure that thousands of international entrepreneurs are already using.

And it's not just about taxes. With the right setup:

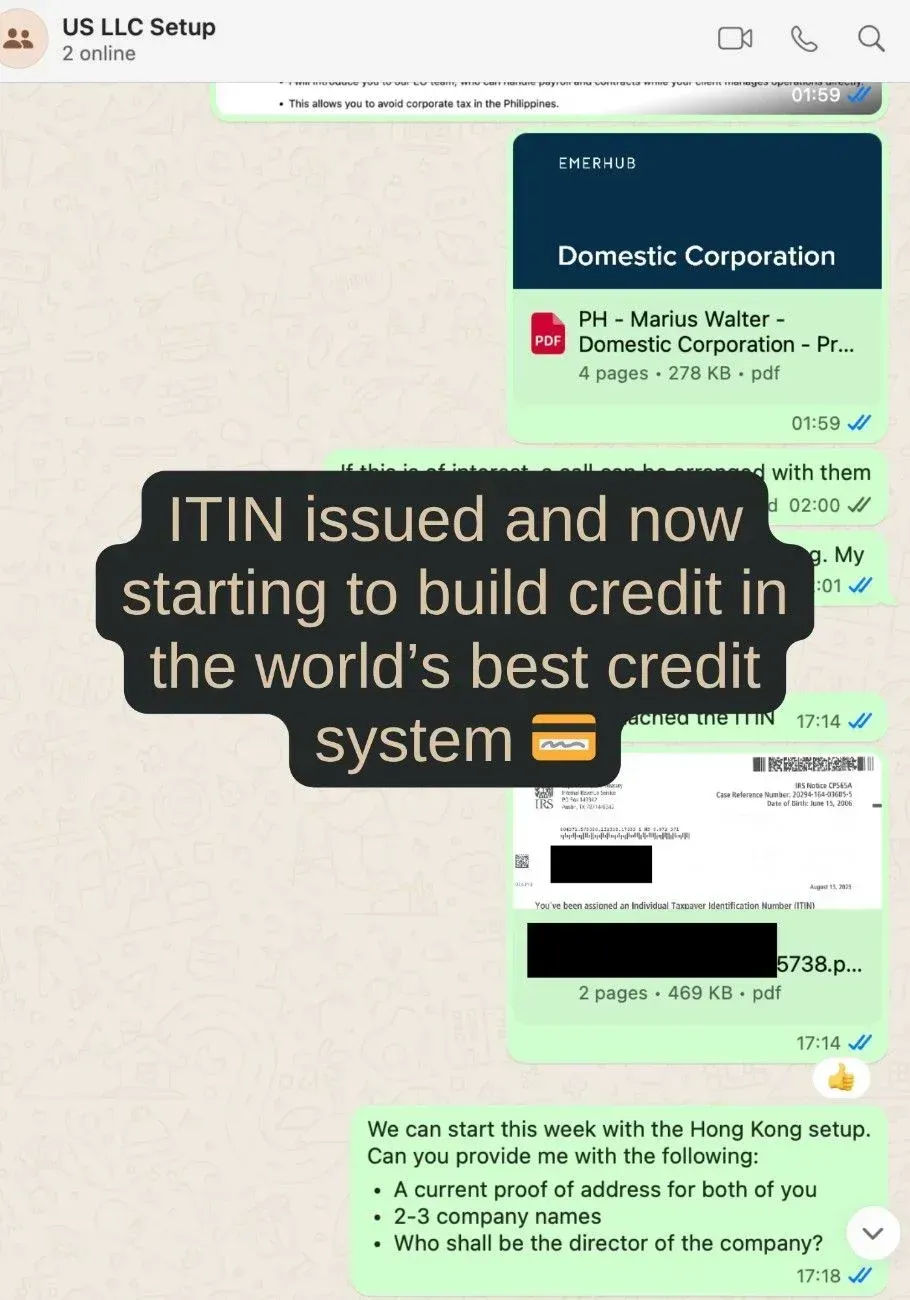

You get access to world-class business banking and credit cards

You avoid messy local bureaucracy.

You gain privacy, flexibility, and international credibility.

But — this only works if your situation is the right fit. That’s why we offer a free 1:1 discovery call to help you:

Find out if you qualify for the US LLC 0% tax structure.

Understand exactly how the setup works.

Get a clear implementation plan – or hands-on support.

This is your opportunity to legally optimize your business, reduce taxes, and scale with less headache.

👉 Watch the video & book your free discovery call.

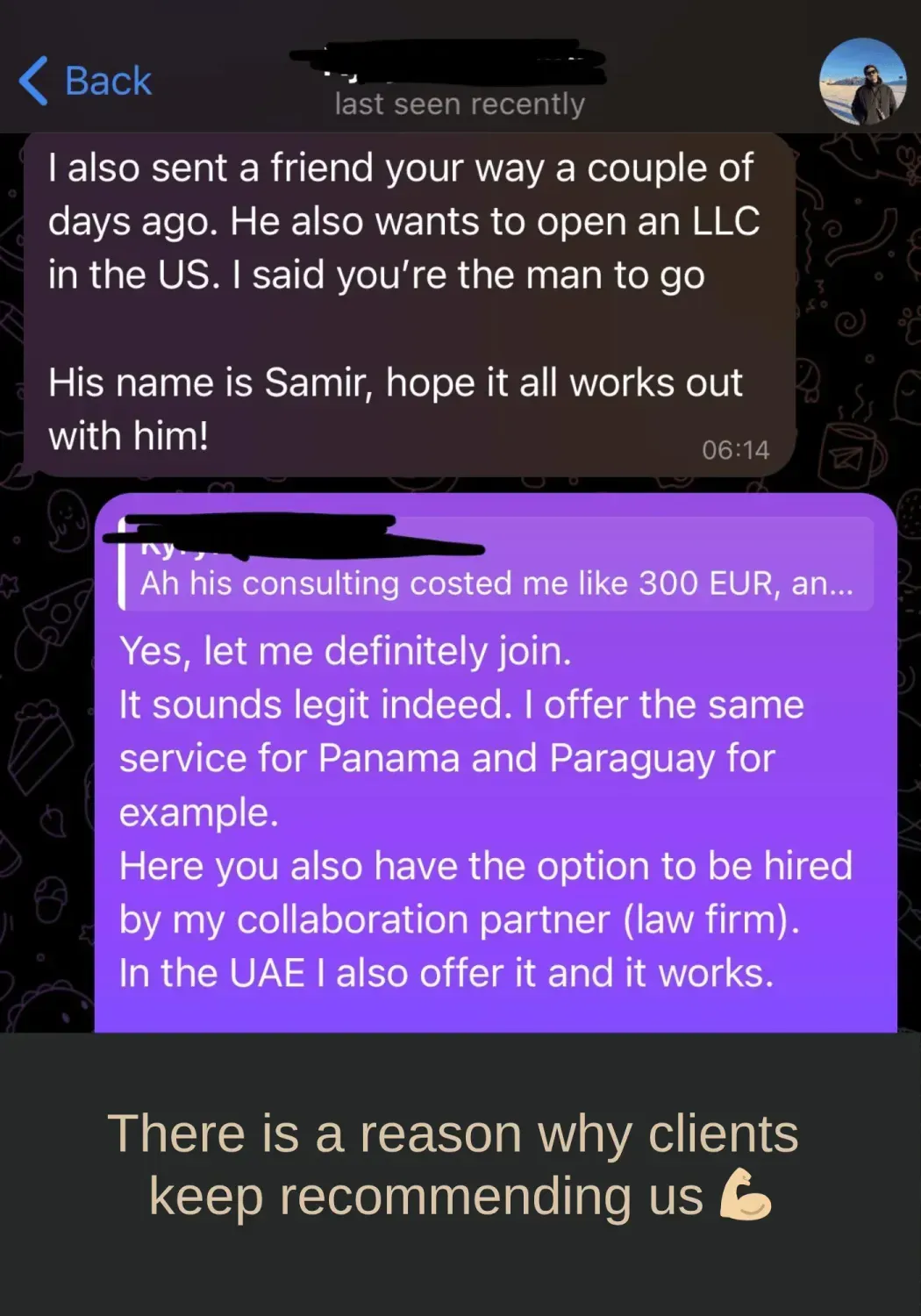

250+ clients use this setup

250+ clients use this setup

Marius Alexander Walter - Founder of GFS

This Strategy Will Work For You, If...

Location Independent

You are not tied to one location, meaning you can work location-independent.

No US Substance

You don’t have business substance in the US (Office, Employees, Contractors etc.)

183-Day Rule

You love to travel and don't need to stay in one country for more than 183 days a year.

Non US-Citizen

You are not a US citizen and you do not plan to live in the US permanently.

250+ clients use this setup

250+ clients use this setup.

Get to Know The Founder

Global Freedom Solutions (GFS) was founded by Marius Walter, a seasoned tax expert with extensive experience in advising entrepreneurs, investors, and businesses on international tax optimization and corporate structuring.

Before establishing GFS, Marius worked at KPMG AG in Germany, specializing in tax advisory, auditing, and capital markets consulting. His background in one of the world’s leading consulting firms provided him with deep expertise in complex tax strategies and compliance across multiple jurisdictions.

With GFS, you gain access to first-class expertise in global tax strategy, international company formations, banking solutions, and asset protection—ensuring you operate efficiently and securely in today’s fast-changing financial landscape.

Globalfreedomsolutions, the Original, known from:

Why You Should Listen To Us

With Globalfreedomsolutions

Without Globalfreedomsolutions

With

Globalfreedomsolutions

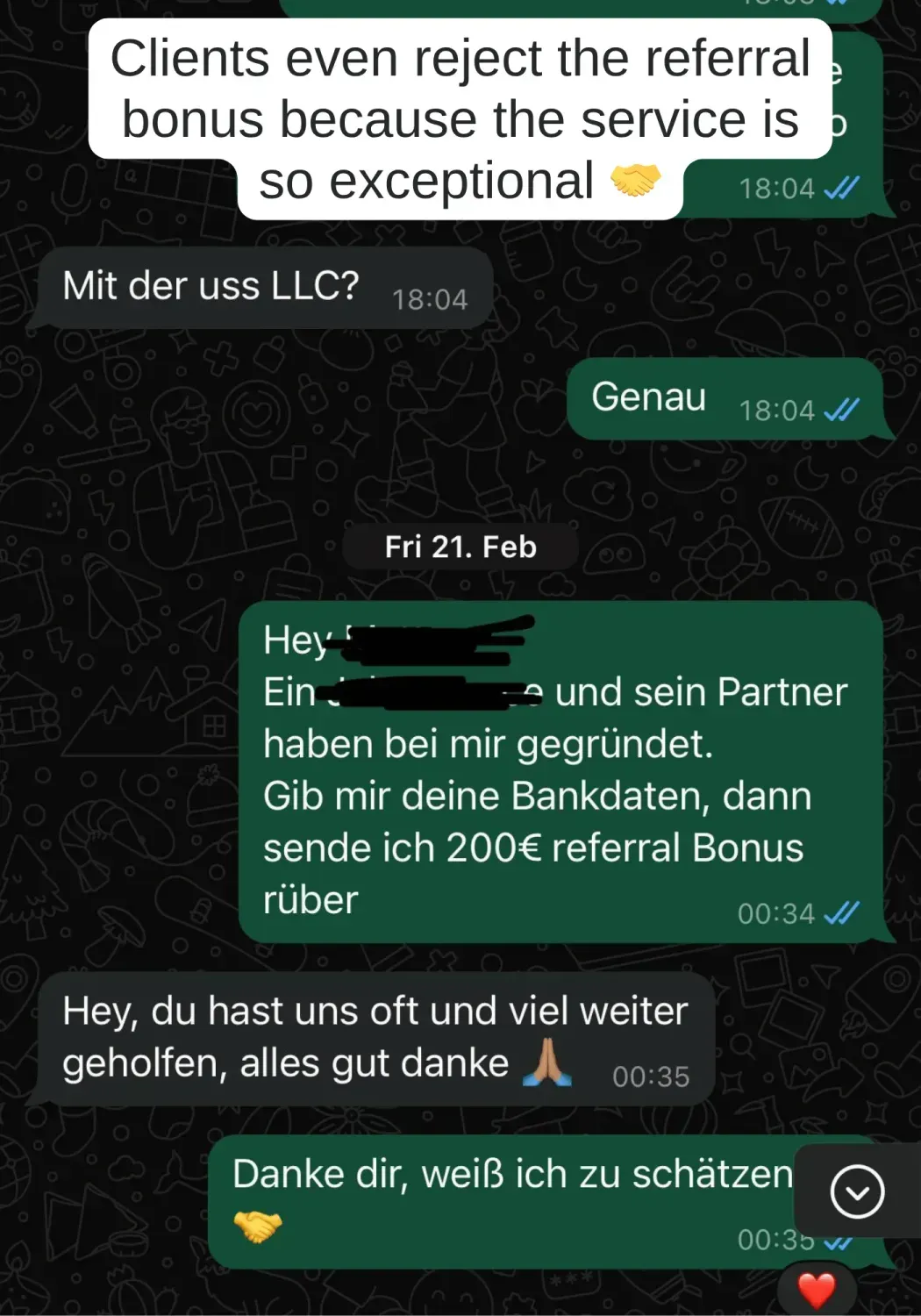

Affordable prices combined with excellent service and personal attention

Experts in US LLCs for US nonresidents – no guesswork, no uncertainty, just precise implementation

Experts in international taxation. Individual advice and incorporation based on specific cases

100% legal & compliant structure (IRS-safe)

Yearly ongoing support with banking, tax filings & platforms

Comprehensive consulting for global setups — USA, Dubai, Cyprus, and more. We also support you with future changes.

Without

Globalfreedomsolutions

Disproportionately high costs without noticeable benefits or real support

No genuine US LLC specialists – unclear answers, incorrect information, and high risk of errors

No experts in international taxation. Pure mass processing without considering individual client cases

No real guidance — risky do-it-yourself mistakes

Just an LLC — no support for banking, Stripe, or PayPal

Limited expertise — no global perspective and no help with alternative structures or adjustments

250+ clients use this setup.

250+ clients use this setup

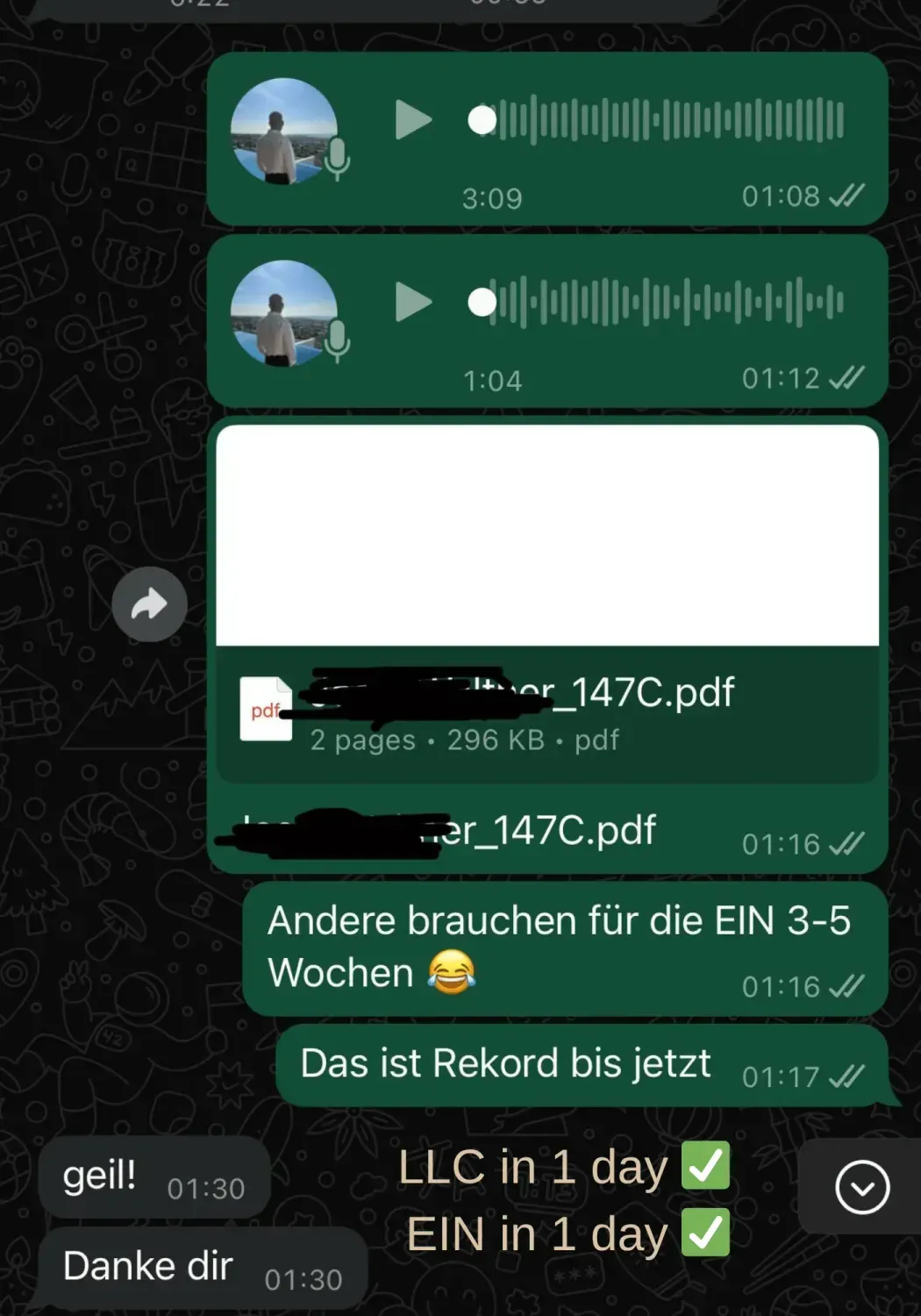

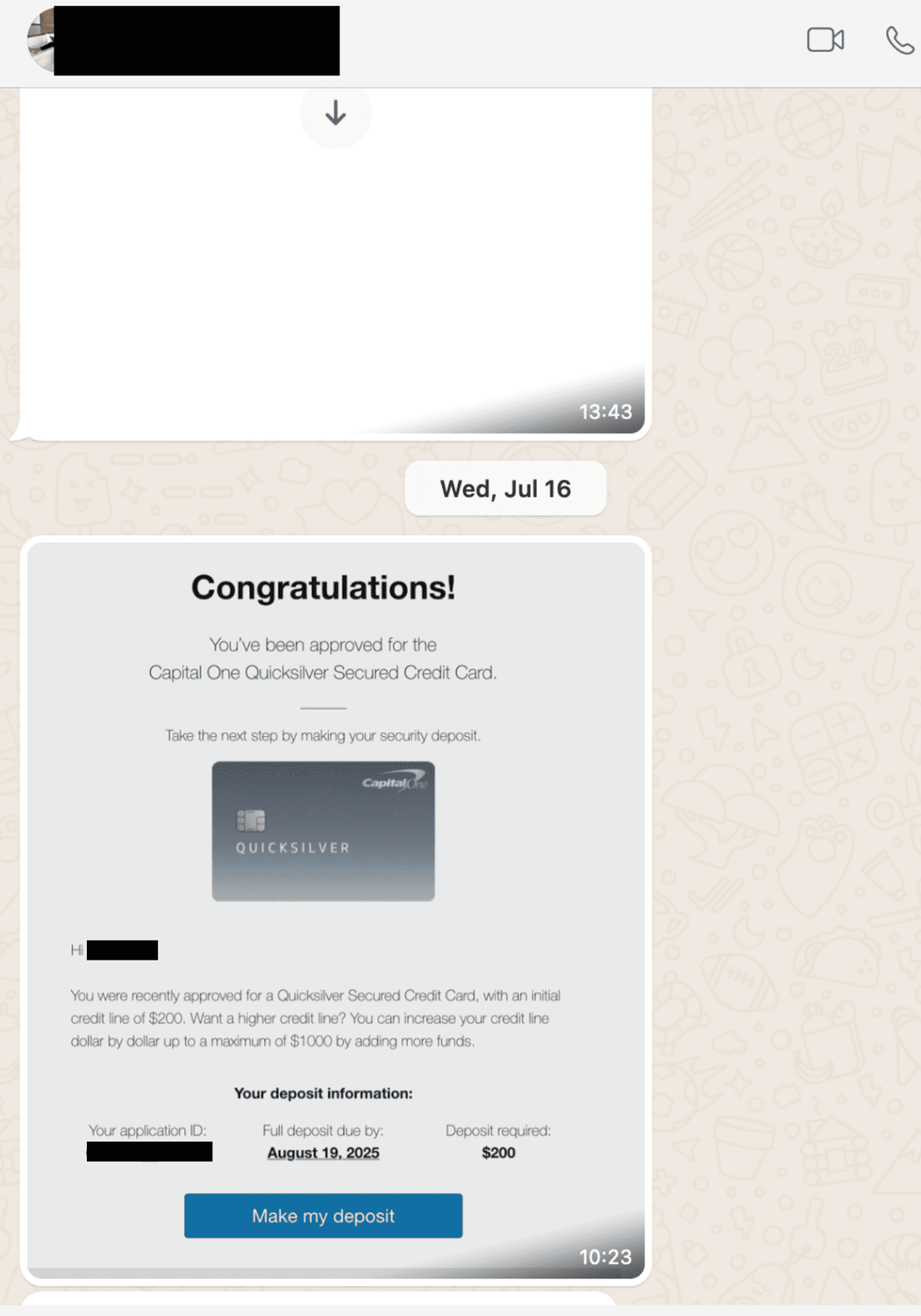

We Always Deliver.

Common Questions

A US LLC (Limited Liability Company) is a business structure that offers personal liability protection and “pass-through” taxation. This means the LLC itself doesn’t pay income tax — instead, profits "pass through" to the owner.

For non-US residents with no US business activity, this setup can legally result in 0% US tax, making it a powerful tool for global entrepreneurs looking to simplify their structure and reduce taxes.

If you're a non-US resident, have no US income and no business activity in the US, the LLC’s profits pass through to you — and the US can’t tax it. That’s how 0% is legally possible.

Yes — this is a 100% legal structure recognized by the IRS, used by thousands of global entrepreneurs. The key is doing it right — and we help you do exactly that.

Yes — as a non-US resident, you can access a wide range of Fintech banking options (like Mercury, Revolut or Wise). In many cases, we also help you open accounts with traditional US banks.

Absolutely — a US LLC gives you full access to platforms like Stripe, PayPal, Wise, and others that require a trusted business setup.

FAST, FAST, FAST! Usually just 1–2 business days.

Just your passport. That’s all we need to form your US LLC and get started.

Yes — we provide full support for banking, Stripe/PayPal, yearly filings, and compliance. No guesswork, no hidden costs.

Reserve your spot

Lorem ipsum dolor sit amet, consectetur, numquam enim ab voluptate id quam.

We HATE spam. Your email address is 100% secure